- United States

- /

- Wireless Telecom

- /

- NYSE:USM

Jay Ellison Is The Executive VP & COO of United States Cellular Corporation (NYSE:USM) And They Just Sold 100% Of Their Shares

We wouldn't blame United States Cellular Corporation (NYSE:USM) shareholders if they were a little worried about the fact that Jay Ellison, the Executive VP & COO recently netted about US$1.1m selling shares at an average price of US$36.20. That diminished their holding by a very significant 100%, which arguably implies a strong desire to reallocate capital.

View our latest analysis for United States Cellular

The Last 12 Months Of Insider Transactions At United States Cellular

The Senior Advisor to the CEO, Kenneth Meyers, made the biggest insider sale in the last 12 months. That single transaction was for US$2.0m worth of shares at a price of US$33.48 each. That means that an insider was selling shares at slightly below the current price (US$36.58). When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. We note that the biggest single sale was only 46% of Kenneth Meyers's holding.

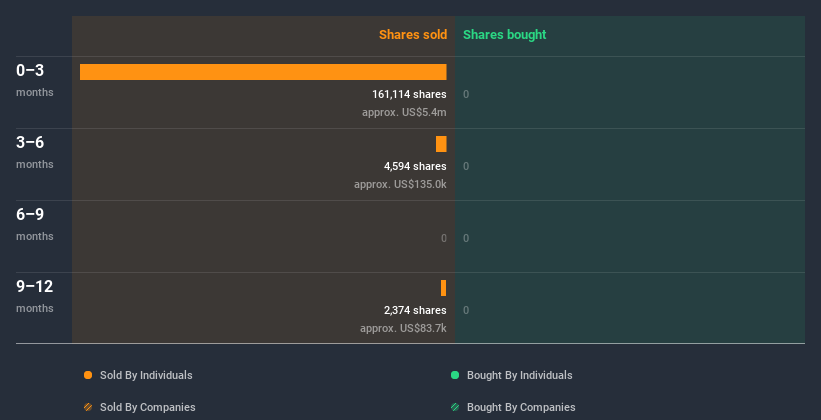

Insiders in United States Cellular didn't buy any shares in the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Insider Ownership of United States Cellular

Many investors like to check how much of a company is owned by insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Insiders own 0.2% of United States Cellular shares, worth about US$7.7m, according to our data. We do generally prefer see higher levels of insider ownership.

What Might The Insider Transactions At United States Cellular Tell Us?

Insiders sold United States Cellular shares recently, but they didn't buy any. Looking to the last twelve months, our data doesn't show any insider buying. On the plus side, United States Cellular makes money, and is growing profits. Insiders own relatively few shares in the company, and when you consider the sales, we're not particularly excited about the stock. So we're not rushing to buy, to say the least. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing United States Cellular. At Simply Wall St, we've found that United States Cellular has 2 warning signs (1 is potentially serious!) that deserve your attention before going any further with your analysis.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading United States Cellular or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:USM

United States Cellular

Provides wireless telecommunications services in the United States.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives