What financial metrics can indicate to us that a company is maturing or even in decline? More often than not, we'll see a declining return on capital employed (ROCE) and a declining amount of capital employed. Trends like this ultimately mean the business is reducing its investments and also earning less on what it has invested. On that note, looking into Responsive Industries (NSE:RESPONIND), we weren't too upbeat about how things were going.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Responsive Industries, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.017 = ₹196m ÷ (₹13b - ₹2.1b) (Based on the trailing twelve months to March 2020).

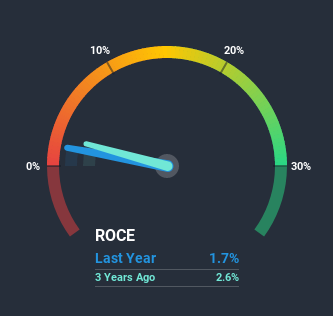

Therefore, Responsive Industries has an ROCE of 1.7%. Ultimately, that's a low return and it under-performs the Chemicals industry average of 13%.

See our latest analysis for Responsive Industries

Historical performance is a great place to start when researching a stock so above you can see the gauge for Responsive Industries' ROCE against it's prior returns. If you're interested in investigating Responsive Industries' past further, check out this free graph of past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

In terms of Responsive Industries' historical ROCE movements, the trend doesn't inspire confidence. About five years ago, returns on capital were 6.0%, however they're now substantially lower than that as we saw above. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. If these trends continue, we wouldn't expect Responsive Industries to turn into a multi-bagger.

The Key Takeaway

All in all, the lower returns from the same amount of capital employed aren't exactly signs of a compounding machine. Investors must expect better things on the horizon though because the stock has risen 19% in the last five years. Regardless, we don't like the trends as they are and if they persist, we think you might find better investments elsewhere.

On a separate note, we've found 1 warning sign for Responsive Industries you'll probably want to know about.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

When trading Responsive Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:RESPONIND

Responsive Industries

Manufactures and sells polyvinyl chloride (PVC) based products in India.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Quanta Services (PWR): Strengthening the Backbone of the AI Power Grid.

KLA Corporation (KLAC): Engineering Yield in the Age of Chiplets and Sub-2nm Nodes.

Monolithic Power Systems (MPWR): The AI "Power Play" Facing a Transition from Scarcity to Scale.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks