Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Quad/Graphics, Inc. (NYSE:QUAD) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Quad/Graphics

How Much Debt Does Quad/Graphics Carry?

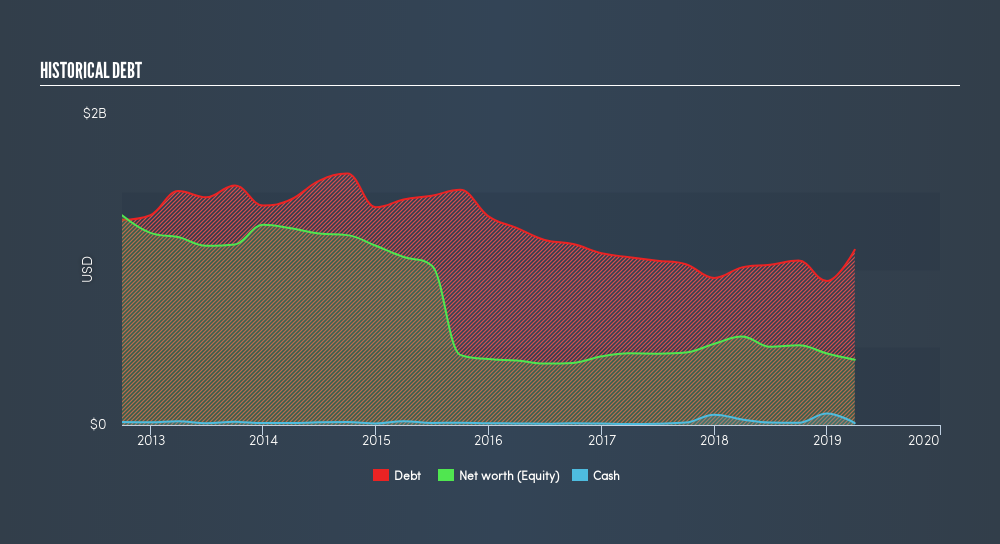

You can click the graphic below for the historical numbers, but it shows that as of March 2019 Quad/Graphics had US$1.14b of debt, an increase on US$1.03b, over one year. Net debt is about the same, since the it doesn't have much cash.

How Strong Is Quad/Graphics's Balance Sheet?

According to the last reported balance sheet, Quad/Graphics had liabilities of US$758.2m due within 12 months, and liabilities of US$1.43b due beyond 12 months. Offsetting this, it had US$12.5m in cash and US$512.3m in receivables that were due within 12 months. So it has liabilities totalling US$1.66b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the US$418.0m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Quad/Graphics would likely require a major re-capitalisation if it had to pay its creditors today. Since Quad/Graphics does have net debt, we think it is worthwhile for shareholders to keep an eye on the balance sheet, over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Quad/Graphics's debt to EBITDA ratio (2.91) suggests that it uses debt fairly modestly, its interest cover is very weak, at 1.98. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Another concern for investors might be that Quad/Graphics's EBIT fell 13% in the last year. If that's the way things keep going handling the debt load will be like delivering hot coffees on a pogo stick. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Quad/Graphics can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Quad/Graphics generated free cash flow amounting to a very robust 86% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

On the face of it, Quad/Graphics's interest cover left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. We're quite clear that we consider Quad/Graphics to be really rather risky, as a result of its debt. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:QUAD

Quad/Graphics

Provides marketing solutions in North America, Mexico, Central America, the Caribbean, Europe, the Middle East, Africa, South America, and Asia.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives