- Switzerland

- /

- Insurance

- /

- SWX:ZURN

Is Now The Time To Put Zurich Insurance Group (VTX:ZURN) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Zurich Insurance Group (VTX:ZURN), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Zurich Insurance Group

Zurich Insurance Group's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. Over the last three years, Zurich Insurance Group has grown EPS by 9.2% per year. That growth rate is fairly good, assuming the company can keep it up.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that Zurich Insurance Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While Zurich Insurance Group did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

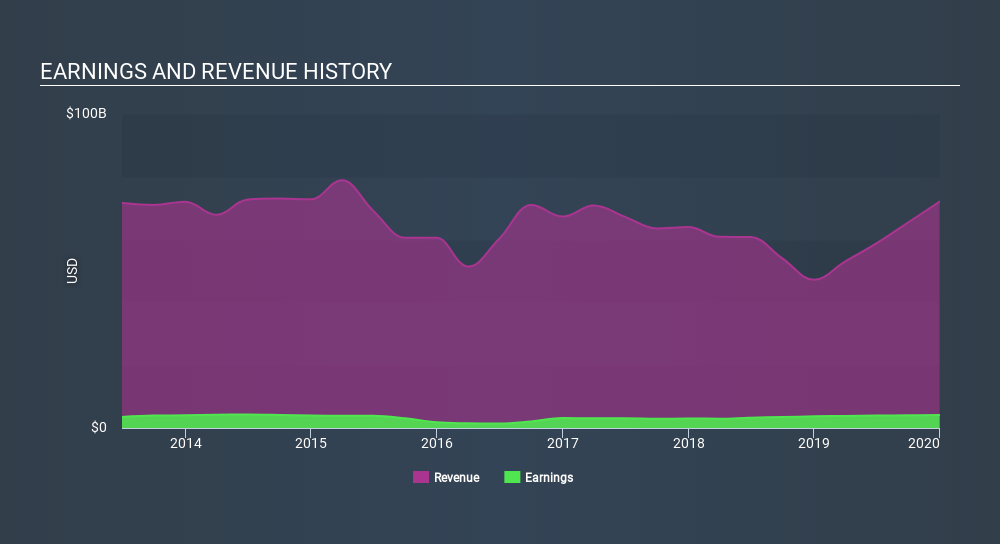

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Zurich Insurance Group EPS 100% free.

Are Zurich Insurance Group Insiders Aligned With All Shareholders?

Since Zurich Insurance Group has a market capitalization of CHF48b, we wouldn't expect insiders to hold a large percentage of shares. But we are reassured by the fact they have invested in the company. Given insiders own a small fortune of shares, currently valued at US$74m, they have plenty of motivation to push the business to succeed. That's certainly enough to make me think that management will be very focussed on long term growth.

Is Zurich Insurance Group Worth Keeping An Eye On?

As I already mentioned, Zurich Insurance Group is a growing business, which is what I like to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Zurich Insurance Group is trading on a high P/E or a low P/E, relative to its industry.

Although Zurich Insurance Group certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SWX:ZURN

Zurich Insurance Group

Provides insurance products and related services in Europe, the Middle East, Africa, North America, Latin America, and the Asia Pacific.

Outstanding track record 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives