- United States

- /

- Banks

- /

- NasdaqGS:HBNC

Is Now The Time To Put Horizon Bancorp (NASDAQ:HBNC) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Horizon Bancorp (NASDAQ:HBNC). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Horizon Bancorp

How Fast Is Horizon Bancorp Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. As a tree reaches steadily for the sky, Horizon Bancorp's EPS has grown 18% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

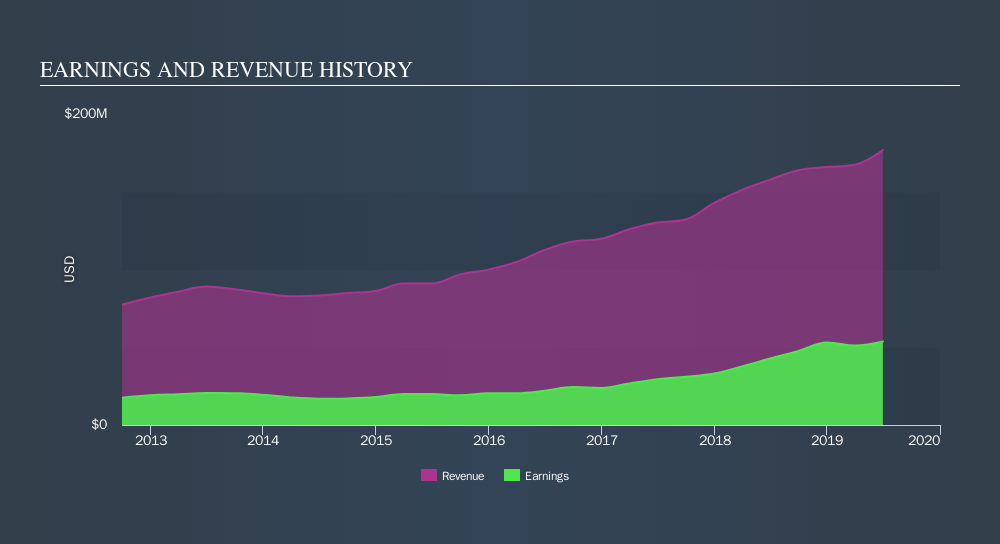

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Horizon Bancorp's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Horizon Bancorp maintained stable EBIT margins over the last year, all while growing revenue 12% to US$177m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Horizon Bancorp's future profits.

Are Horizon Bancorp Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did Horizon Bancorp insiders refrain from selling stock during the year, but they also spent US$135k buying it. That's nice to see, because it suggests insiders are optimistic. Zooming in, we can see that the biggest insider purchase was by President James Neff for US$55k worth of shares, at about US$15.77 per share.

On top of the insider buying, it's good to see that Horizon Bancorp insiders have a valuable investment in the business. To be specific, they have US$44m worth of shares. That's a lot of money, and no small incentive to work hard. That amounts to 5.6% of the company, demonstrating a degree of high-level alignment with shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Craig Dwight is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations between US$400m and US$1.6b, like Horizon Bancorp, the median CEO pay is around US$2.7m.

The Horizon Bancorp CEO received total compensation of just US$1.2m in the year to December 2018. That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does Horizon Bancorp Deserve A Spot On Your Watchlist?

You can't deny that Horizon Bancorp has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Horizon Bancorp is trading on a high P/E or a low P/E, relative to its industry.

As a growth investor I do like to see insider buying. But Horizon Bancorp isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:HBNC

Horizon Bancorp

Operates as the bank holding company for Horizon Bank that engages in the provision of commercial and retail banking services.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives