- United States

- /

- Banks

- /

- NasdaqCM:CVCY

Is Now The Time To Put Central Valley Community Bancorp (NASDAQ:CVCY) On Your Watchlist?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Central Valley Community Bancorp (NASDAQ:CVCY). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Central Valley Community Bancorp

Central Valley Community Bancorp's Earnings Per Share Are Growing.

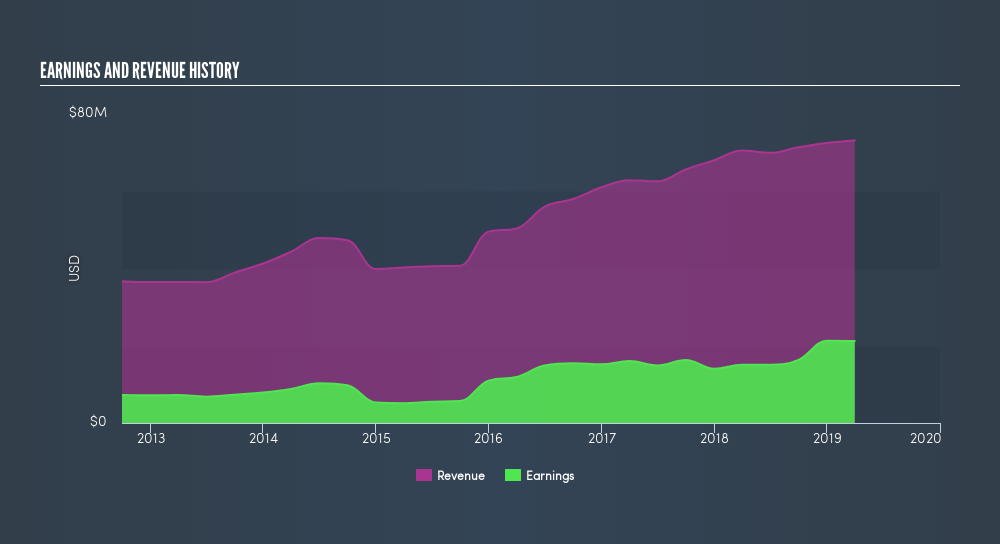

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Central Valley Community Bancorp grew its EPS by 13% per year. That's a pretty good rate, if the company can sustain it.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of Central Valley Community Bancorp's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Central Valley Community Bancorp's EBIT margins were flat over the last year, revenue grew by a solid 3.7% to US$73m. That's a real positive.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Central Valley Community Bancorp's future profits.

Are Central Valley Community Bancorp Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We note that Central Valley Community Bancorp insiders spent US$65k on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic.

On top of the insider buying, it's good to see that Central Valley Community Bancorp insiders have a valuable investment in the business. To be specific, they have US$43m worth of shares. That's a lot of money, and no small incentive to work hard. Those holdings account for over 15% of the company; visible skin in the game.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Jim Ford, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Central Valley Community Bancorp with market caps between US$100m and US$400m is about US$1.2m.

The Central Valley Community Bancorp CEO received US$659k in compensation for the year ending December 2018. That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Central Valley Community Bancorp To Your Watchlist?

One important encouraging feature of Central Valley Community Bancorp is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Central Valley Community Bancorp. You might benefit from giving it a glance today.

As a growth investor I do like to see insider buying. But Central Valley Community Bancorp isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:CVCY

Central Valley Community Bancorp

Operates as the bank holding company for the Central Valley Community Bank that provides various commercial banking services to small and middle-market businesses and individuals in California.

Undervalued with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives