The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies. Matson, Inc. (NYSE:MATX) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Matson

How Much Debt Does Matson Carry?

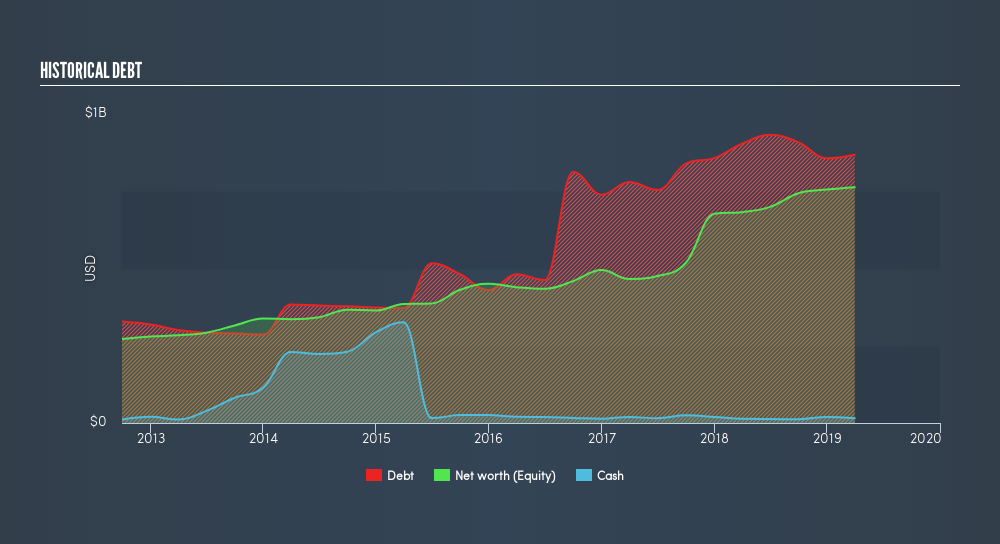

As you can see below, Matson had US$868.1m of debt, at March 2019, which is about the same the year before. You can click the chart for greater detail. Net debt is about the same, since the it doesn't have much cash.

How Healthy Is Matson's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Matson had liabilities of US$411.1m due within 12 months and liabilities of US$1.50b due beyond that. Offsetting these obligations, it had cash of US$15.4m as well as receivables valued at US$217.9m due within 12 months. So its liabilities total US$1.68b more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of US$1.70b. So should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. Because it carries more debt than cash, we think it's worth watching Matson's balance sheet over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Matson has a debt to EBITDA ratio of 3.95 and its EBIT covered its interest expense 6.64 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Unfortunately, Matson saw its EBIT slide 5.4% in the last twelve months. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Matson's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Matson burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Mulling over Matson's attempt at converting EBIT to free cash flow, we're certainly not enthusiastic. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. We're quite clear that we consider Matson to be really rather risky, as a result of its debt. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on the balance sheet . In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:MATX

Matson

Engages in the provision of ocean transportation and logistics services.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

The Real Power Behind Alphabet’s Growth

RELX: The Quiet Compounder Powering Law, Science, and Risk Intelligence

Why CVS’s Valuation Signals Opportunity

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026