Is JEMTEC Inc. (CVE:JTC) Excessively Paying Its CEO?

The CEO of JEMTEC Inc. (CVE:JTC) is Eric Caton. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Then we'll look at a snap shot of the business growth. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for JEMTEC

How Does Eric Caton's Compensation Compare With Similar Sized Companies?

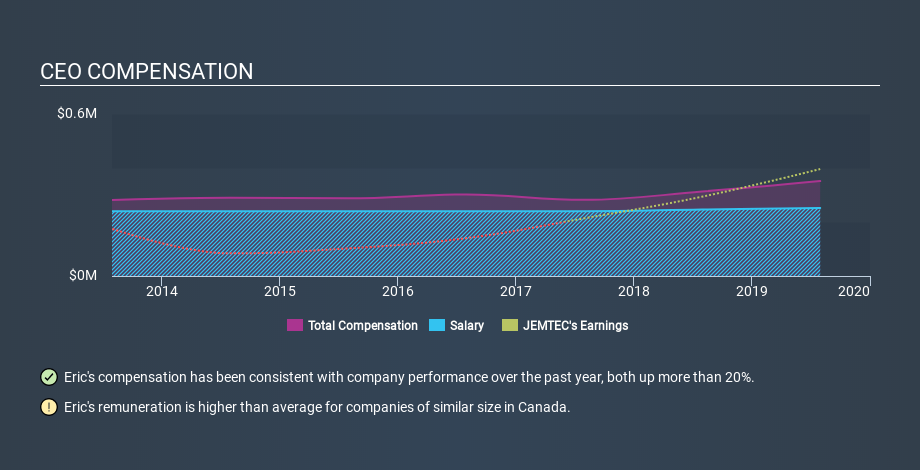

Our data indicates that JEMTEC Inc. is worth CA$3.5m, and total annual CEO compensation was reported as CA$352k for the year to July 2019. While we always look at total compensation first, we note that the salary component is less, at CA$252k. We looked at a group of companies with market capitalizations under CA$284m, and the median CEO total compensation was CA$222k.

As you can see, Eric Caton is paid more than the median CEO pay at companies of a similar size, in the same market. However, this does not necessarily mean JEMTEC Inc. is paying too much. We can get a better idea of how generous the pay is by looking at the performance of the underlying business.

You can see, below, how CEO compensation at JEMTEC has changed over time.

Is JEMTEC Inc. Growing?

On average over the last three years, JEMTEC Inc. has grown earnings per share (EPS) by 97% each year (using a line of best fit). Its revenue is up 11% over last year.

This demonstrates that the company has been improving recently. A good result. It's a real positive to see this sort of growth in a single year. That suggests a healthy and growing business. Although we don't have analyst forecasts you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has JEMTEC Inc. Been A Good Investment?

I think that the total shareholder return of 283%, over three years, would leave most JEMTEC Inc. shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

We compared total CEO remuneration at JEMTEC Inc. with the amount paid at companies with a similar market capitalization. Our data suggests that it pays above the median CEO pay within that group.

Importantly, though, the company has impressed with its earnings per share growth, over three years. Even better, returns to shareholders have been plentiful, over the same time period. So, considering this good performance, the CEO compensation may be quite appropriate. On another note, JEMTEC has 3 warning signs (and 1 which is significant) we think you should know about.

If you want to buy a stock that is better than JEMTEC, this free list of high return, low debt companies is a great place to look.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:JTC

JEMTEC

Provides integrated technology systems for community-based corrections in Canada.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

GameStop will ace the financial crisis wave with its strategic Bitcoin investment and cash reserves

BABA Analysis: Buying the Fear, Holding the Cloud

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale