- India

- /

- Commercial Services

- /

- NSEI:LINC

Is It Worth Considering Linc Pen & Plastics Limited (NSE:LINCPEN) For Its Upcoming Dividend?

It looks like Linc Pen & Plastics Limited (NSE:LINCPEN) is about to go ex-dividend in the next three days. This means that investors who purchase shares on or after the 17th of September will not receive the dividend, which will be paid on the 25th of October.

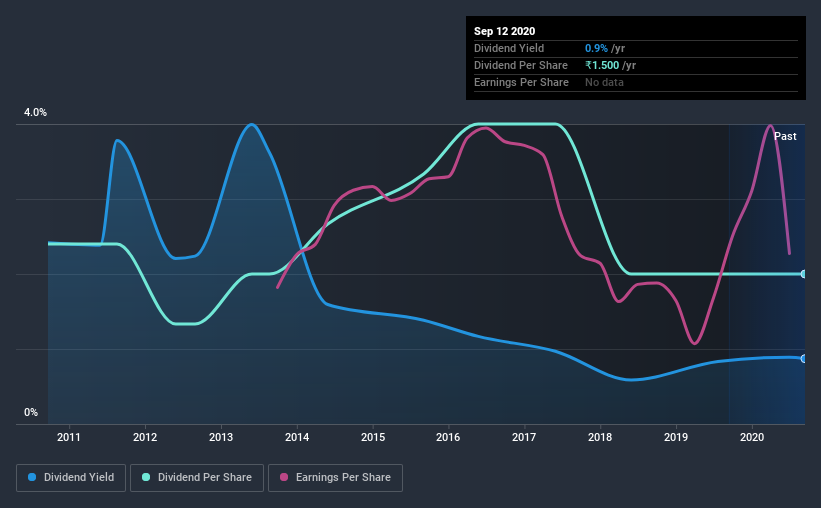

Linc Pen & Plastics's next dividend payment will be ₹1.50 per share, and in the last 12 months, the company paid a total of ₹1.50 per share. Based on the last year's worth of payments, Linc Pen & Plastics stock has a trailing yield of around 0.9% on the current share price of ₹172.05. If you buy this business for its dividend, you should have an idea of whether Linc Pen & Plastics's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Linc Pen & Plastics

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Linc Pen & Plastics is paying out just 20% of its profit after tax, which is comfortably low and leaves plenty of breathing room in the case of adverse events. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. The good news is it paid out just 8.1% of its free cash flow in the last year.

It's positive to see that Linc Pen & Plastics's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Linc Pen & Plastics paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. With that in mind, we're discomforted by Linc Pen & Plastics's 5.3% per annum decline in earnings in the past five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Linc Pen & Plastics's dividend payments per share have declined at 1.8% per year on average over the past 10 years, which is uninspiring.

Final Takeaway

From a dividend perspective, should investors buy or avoid Linc Pen & Plastics? Earnings per share are down meaningfully, although at least the company is paying out a low and conservative percentage of both its earnings and cash flow. It's definitely not great to see earnings falling, but at least there may be some buffer before the dividend needs to be cut. In summary, it's hard to get excited about Linc Pen & Plastics from a dividend perspective.

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. Every company has risks, and we've spotted 3 warning signs for Linc Pen & Plastics (of which 1 makes us a bit uncomfortable!) you should know about.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Linc Pen & Plastics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:LINC

Linc

Manufactures and sells writing instruments and stationery products in India and internationally.

Flawless balance sheet average dividend payer.