- Greece

- /

- Personal Products

- /

- ATSE:SAR

Is Gr. Sarantis S.A.'s (ATH:SAR) P/E Ratio Really That Good?

The goal of this article is to teach you how to use price to earnings ratios (P/E ratios). To keep it practical, we'll show how Gr. Sarantis S.A.'s (ATH:SAR) P/E ratio could help you assess the value on offer. What is Gr. Sarantis's P/E ratio? Well, based on the last twelve months it is 15.71. That corresponds to an earnings yield of approximately 6.4%.

View our latest analysis for Gr. Sarantis

How Do You Calculate A P/E Ratio?

The formula for P/E is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for Gr. Sarantis:

P/E of 15.71 = €8.04 ÷ €0.51 (Based on the trailing twelve months to June 2019.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio means that investors are paying a higher price for each €1 of company earnings. That is not a good or a bad thing per se, but a high P/E does imply buyers are optimistic about the future.

Does Gr. Sarantis Have A Relatively High Or Low P/E For Its Industry?

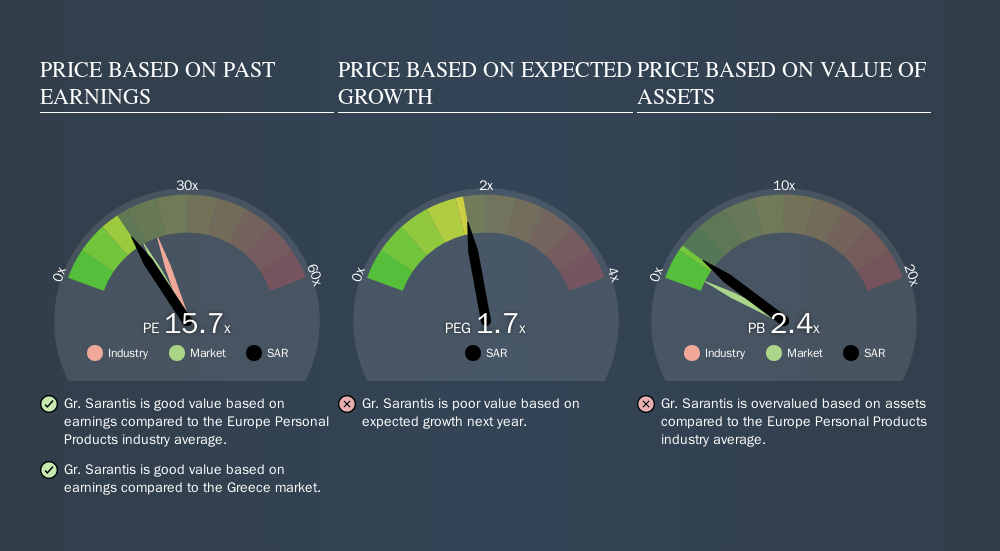

The P/E ratio essentially measures market expectations of a company. The image below shows that Gr. Sarantis has a lower P/E than the average (21.7) P/E for companies in the personal products industry.

Gr. Sarantis's P/E tells us that market participants think it will not fare as well as its peers in the same industry.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. That's because companies that grow earnings per share quickly will rapidly increase the 'E' in the equation. That means unless the share price increases, the P/E will reduce in a few years. Then, a lower P/E should attract more buyers, pushing the share price up.

Gr. Sarantis increased earnings per share by a whopping 29% last year. And it has bolstered its earnings per share by 20% per year over the last five years. I'd therefore be a little surprised if its P/E ratio was not relatively high. The market might therefore be optimistic about the future, but that doesn't guarantee future growth. So investors should delve deeper. I like to check if company insiders have been buying or selling.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

The 'Price' in P/E reflects the market capitalization of the company. So it won't reflect the advantage of cash, or disadvantage of debt. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

Gr. Sarantis's Balance Sheet

Net debt totals just 4.9% of Gr. Sarantis's market cap. It would probably trade on a higher P/E ratio if it had a lot of cash, but I doubt it is having a big impact.

The Verdict On Gr. Sarantis's P/E Ratio

Gr. Sarantis's P/E is 15.7 which is below average (17.5) in the GR market. The company hasn't stretched its balance sheet, and earnings growth was good last year. If the company can continue to grow earnings, then the current P/E may be unjustifiably low. Because analysts are predicting more growth in the future, one might have expected to see a higher P/E ratio. You can take a closer look at the fundamentals, here.

Investors should be looking to buy stocks that the market is wrong about. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

You might be able to find a better buy than Gr. Sarantis. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ATSE:SAR

Gr. Sarantis

Produces and trades in cosmetics, household products, and pharmaceutical items in Greece, Portugal, Poland, Romania, Bulgaria, Serbia, Bosnia-Herzegovina, North Macedonia, Slovenia, Czech-Slovakia, Hungary, and Ukraine.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Is This Lens Maker Mispriced? A Blind Spot in Plain Sight

From Porcelain to Silicon: Why the World’s Most Famous Toilet Maker is Now an AI Powerhouse

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks