Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Dundee Precious Metals Inc. (TSE:DPM) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Dundee Precious Metals

What Is Dundee Precious Metals's Debt?

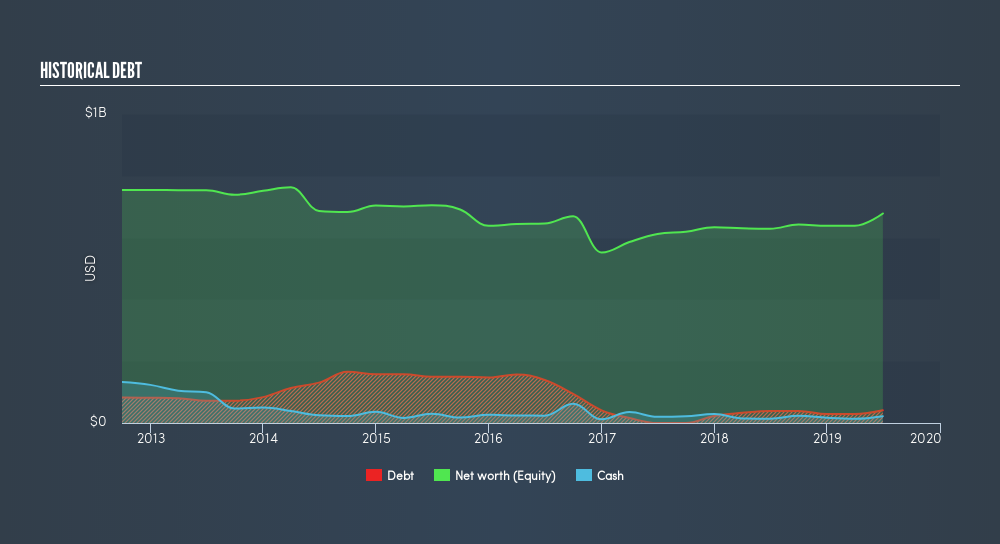

As you can see below, Dundee Precious Metals had US$23.4m of debt at June 2019, down from US$56.6m a year prior. However, it also had US$22.2m in cash, and so its net debt is US$1.26m.

How Healthy Is Dundee Precious Metals's Balance Sheet?

According to the last reported balance sheet, Dundee Precious Metals had liabilities of US$102.6m due within 12 months, and liabilities of US$128.8m due beyond 12 months. On the other hand, it had cash of US$22.2m and US$40.7m worth of receivables due within a year. So its liabilities total US$168.5m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Dundee Precious Metals has a market capitalization of US$694.6m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. Carrying virtually no net debt, Dundee Precious Metals has a very light debt load indeed.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Dundee Precious Metals has very modest net debt, giving rise to a debt to EBITDA ratio of 0.011. And this impression is enhanced by its strong EBIT which covers interest costs 8.6 times. Another good sign is that Dundee Precious Metals has been able to increase its EBIT by 22% in twelve months, making it easier to pay down debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Dundee Precious Metals can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Considering the last two years, Dundee Precious Metals actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

Dundee Precious Metals's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered were considerably better In particular, we are dazzled with its EBIT growth rate. When we consider all the elements mentioned above, it seems to us that Dundee Precious Metals is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Dundee Precious Metals insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:DPM

Dundee Precious Metals

A gold mining company, engages in the acquisition, exploration, development, mining, and processing of precious metals.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives