Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Dividend paying stocks like Banque Cantonale du Jura SA (VTX:BCJ) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

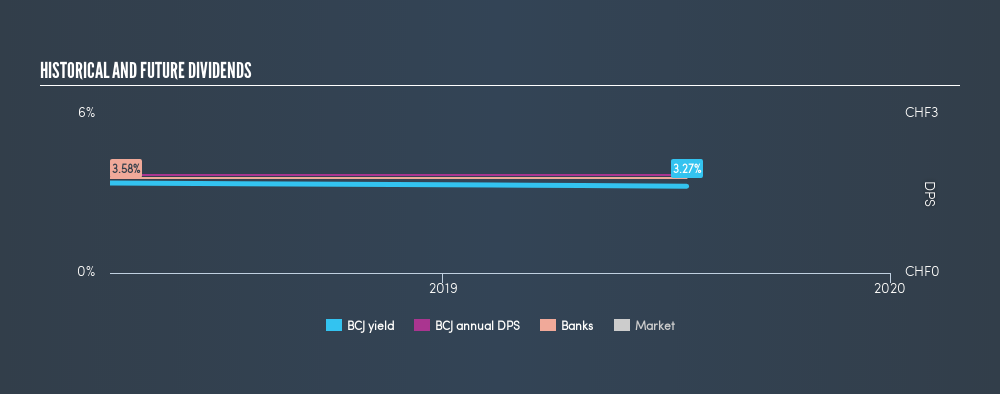

Banque Cantonale du Jura has only been paying a dividend for a year or so, so investors might be curious about its 3.3% yield. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 56% of Banque Cantonale du Jura's profits were paid out as dividends in the last 12 months. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. This company has been paying a dividend for less than 2 years, which we think is too soon to consider it a reliable dividend stock. Its most recent annual dividend was CHF1.85 per share.

We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Dividend Growth Potential

Examining whether the dividend is affordable and stable is important. However, it's also important to assess if earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. Banque Cantonale du Jura's EPS are effectively flat over the past five years. Flat earnings per share are acceptable for a time, but over the long term, the purchasing power of the company's dividends could be eroded by inflation. Growth of 2.0% is relatively anaemic growth, which we wonder about. If the company is struggling to grow, perhaps that's why it elects to pay out more than half of its earnings to shareholders.

Conclusion

To summarise, shareholders should always check that Banque Cantonale du Jura's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Banque Cantonale du Jura's payout ratio is within normal bounds. Second, earnings growth has been ordinary, and its history of dividend payments is shorter than we'd like. Banque Cantonale du Jura might not be a bad business, but it doesn't show all of the characteristics we look for in a dividend stock.

Are management backing themselves to deliver performance? Check their shareholdings in Banque Cantonale du Jura in our latest insider ownership analysis.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SWX:BCJ

Banque Cantonale du Jura

Provides various banking products and services to individuals and businesses in Switzerland.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives