The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you pick the right stock, you can make a lot more than 100%. For example, the Alteryx, Inc. (NYSE:AYX) share price has soared 209% in the last year. Most would be very happy with that, especially in just one year! It's also good to see the share price up 37% over the last quarter. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

See our latest analysis for Alteryx

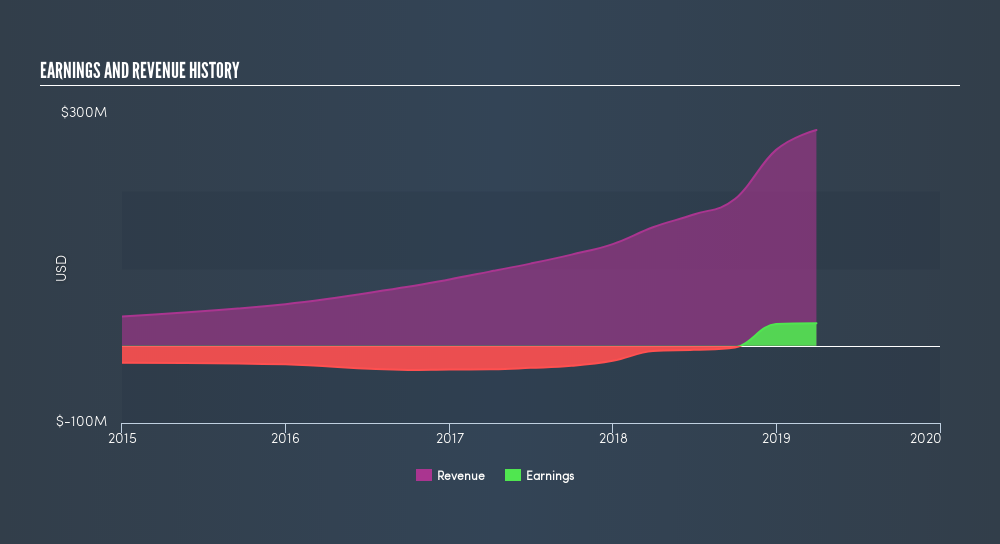

Given that Alteryx only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last year Alteryx saw its revenue grow by 82%. That's stonking growth even when compared to other loss-making stocks. And the share price has responded, gaining 209% as we previously mentioned. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. Given the positive sentiment around the stock we're cautious, but there's no doubt its worth watching.

Alteryx is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

Alteryx boasts a total shareholder return of 209% for the last year. That's better than the more recent three month gain of 37%, implying that share price has plateaued recently. Having said that, we doubt shareholders would be concerned. It seems the market is simply waiting on more information, because if the business delivers so will the share price (eventually). Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: Alteryx may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:AYX

Alteryx

Alteryx, Inc., together with its subsidiaries, operates in the analytics automation business in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives