- United States

- /

- Software

- /

- NasdaqGS:IREN

IREN (NasdaqGS:IREN) Sees 183% Stock Surge Over Last Quarter

Reviewed by Simply Wall St

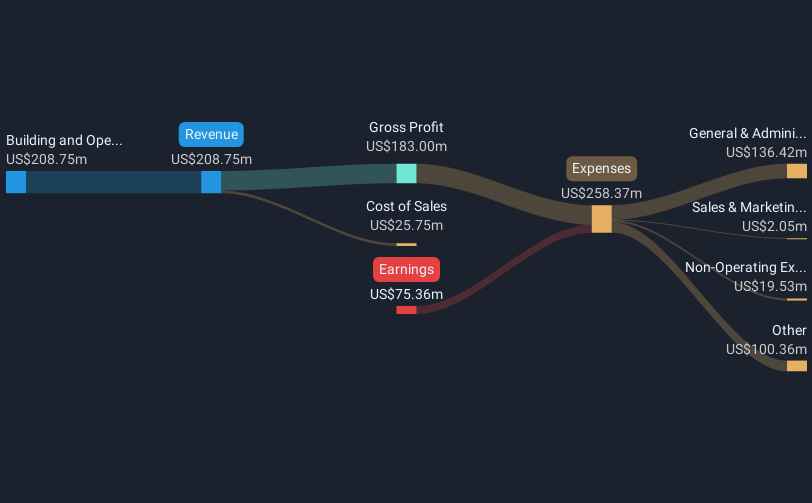

IREN (NasdaqGS:IREN) recently appointed Anthony Lewis as Chief Capital Officer, emphasizing the company's focus on capital markets and AI infrastructure investments. This move, alongside strong quarterly earnings, likely added momentum to IREN's impressive 183% price increase over the last quarter. The company's Q3 2025 sales rose significantly, complementing the broader market growth of 2.1% in the past week and 14% over the past year. Additionally, its efforts to boost self-mining capacity align with these positive developments, reinforcing investor confidence despite flat market earnings forecasts for 15% annual growth. Such factors collectively contributed to IREN's performance.

Every company has risks, and we've spotted 2 possible red flags for IREN you should know about.

IREN’s recent appointment of Anthony Lewis as Chief Capital Officer reinforces its focus on capital markets and AI infrastructure investments, aligning with its broader strategic shift. This move could enhance the company’s capital allocation efficiency, potentially bolstering revenue and driving earnings growth, especially as the company transitions from crypto mining to high-return AI and cloud infrastructure. This shift anticipates a significant margin improvement over the longer term despite the inherent volatility of the crypto sector.

Over the past three years, IREN’s total return, including dividends, was a significant 362.09%, underlining its robust performance. For context, the company’s shares have risen approximately 183% just in the last quarter, sharply contrasting with its one-year performance where it exceeded the US market's 14.3% return. However, IREN underperformed the US Software industry, which returned 18.4% over the same one-year period.

In light of these strategic developments, analysts forecast a potential 53.1% annual revenue growth over the coming years. Earnings are projected to shift significantly from a loss of US$35.67 million to reaching US$485.2 million by 2028. Despite this positive outlook, the current share price of US$15.23 suggests an 18.6% potential upside relative to the consensus price target of US$18.70, emphasizing an opportunity for value realization if the company can successfully execute its strategic initiatives.

Assess IREN's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IREN

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives