- France

- /

- Healthcare Services

- /

- ENXTPA:CLARI

Investors Who Bought Korian (EPA:KORI) Shares Three Years Ago Are Now Up 59%

By buying an index fund, investors can approximate the average market return. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. Just take a look at Korian (EPA:KORI), which is up 59%, over three years, soundly beating the market return of 29% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 26% , including dividends .

Check out our latest analysis for Korian

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

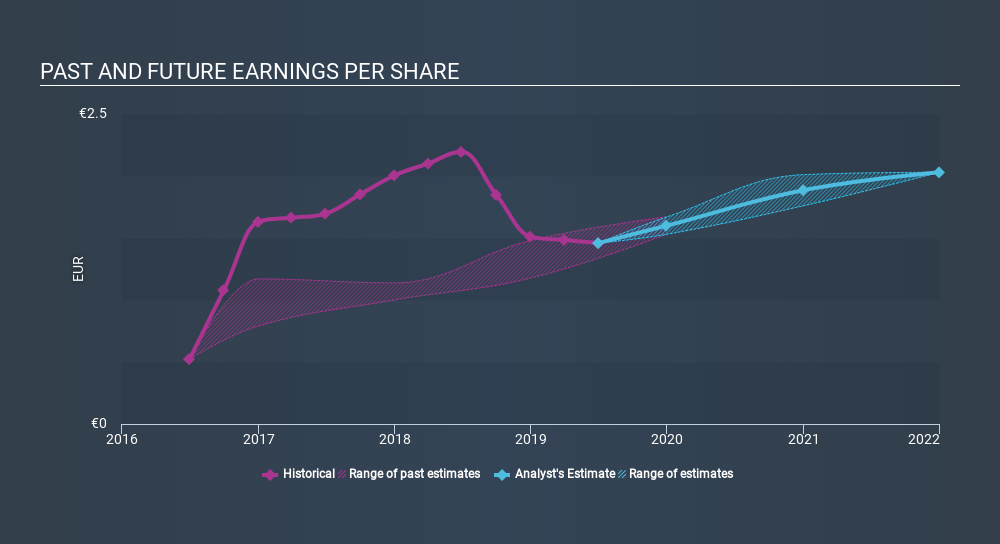

During three years of share price growth, Korian achieved compound earnings per share growth of 41% per year. This EPS growth is higher than the 17% average annual increase in the share price. Therefore, it seems the market has moderated its expectations for growth, somewhat.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Korian has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Korian's financial health with this free report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Korian, it has a TSR of 68% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Korian provided a TSR of 26% over the year (including dividends) . That's fairly close to the broader market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 9.6%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. Before deciding if you like the current share price, check how Korian scores on these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTPA:CLARI

Clariane

Provides care home, healthcare facilities and services, and shared living solutions in France, Germany, Benelux, Italy, Spain, and the United Kingdom.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives