- Hong Kong

- /

- Construction

- /

- SEHK:611

Investors Who Bought China Nuclear Energy Technology (HKG:611) Shares Three Years Ago Are Now Down 76%

Every investor on earth makes bad calls sometimes. But really bad investments should be rare. So spare a thought for the long term shareholders of China Nuclear Energy Technology Corporation Limited (HKG:611); the share price is down a whopping 76% in the last three years. That would be a disturbing experience. And over the last year the share price fell 41%, so we doubt many shareholders are delighted. The last week also saw the share price slip down another 6.8%.

View our latest analysis for China Nuclear Energy Technology

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

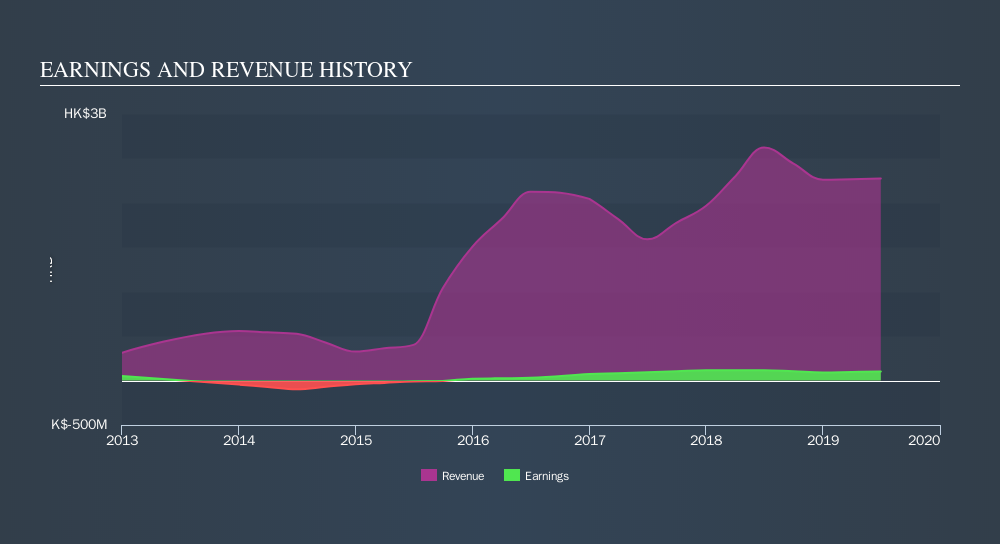

Although the share price is down over three years, China Nuclear Energy Technology actually managed to grow EPS by 42% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Revenue is actually up 8.4% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching China Nuclear Energy Technology more closely, as sometimes stocks fall unfairly. This could present an opportunity.

The image below shows how earnings and revenue have tracked over time.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 8.7% in the last year, China Nuclear Energy Technology shareholders lost 41%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 20% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. You could get a better understanding of China Nuclear Energy Technology's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:611

China Nuclear Energy Technology

An investment holding company, provides engineering, procurement, and construction (EPC) services for photovoltaic power plants in the People’s Republic of China.

Solid track record and slightly overvalued.

Market Insights

Community Narratives