Investors Who Bought AAK AB (publ.) (STO:AAK) Shares Five Years Ago Are Now Up 93%

When we invest, we're generally looking for stocks that outperform the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, the AAK AB (publ.) (STO:AAK) share price is up 93% in the last 5 years, clearly besting the market return of around -7.3% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 20% , including dividends .

Check out our latest analysis for AAK AB (publ.)

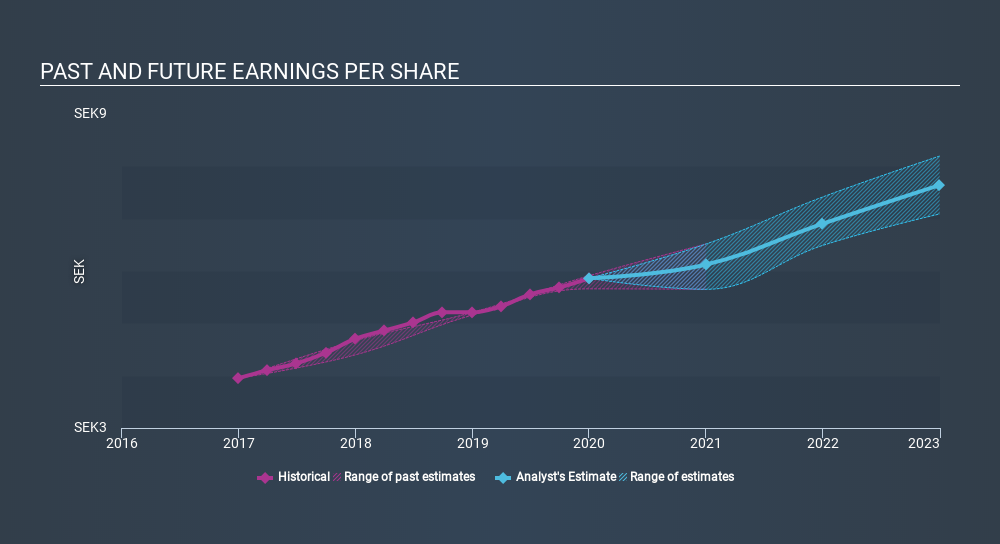

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, AAK AB (publ.) achieved compound earnings per share (EPS) growth of 11% per year. This EPS growth is lower than the 14% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that AAK AB (publ.) has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, AAK AB (publ.)'s TSR for the last 5 years was 106%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that AAK AB (publ.) has rewarded shareholders with a total shareholder return of 20% in the last twelve months. Of course, that includes the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 16% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. If you would like to research AAK AB (publ.) in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OM:AAK

AAK AB (publ.)

Develops and sells plant-based oils and fats in Sweden and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives