- United States

- /

- Capital Markets

- /

- NYSE:VIRT

Investors In Virtu Financial, Inc. (NASDAQ:VIRT) Should Consider This, First

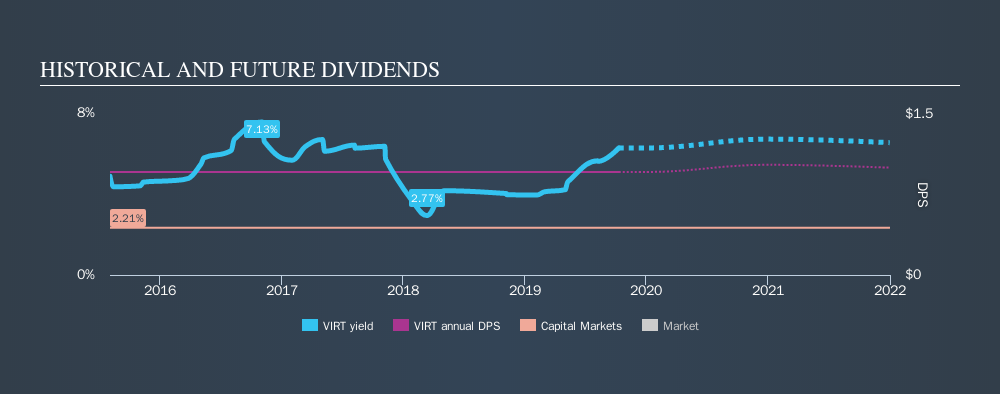

Today we'll take a closer look at Virtu Financial, Inc. (NASDAQ:VIRT) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

So you might want to consider getting our latest analysis on Virtu Financial's financial health here.

With a goodly-sized dividend yield despite a relatively short payment history, investors might be wondering if Virtu Financial is a new dividend aristocrat in the making. We'd agree the yield does look enticing. The company also bought back stock equivalent to around 1.3% of market capitalisation this year. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Virtu Financial!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Virtu Financial paid out 207% of its profit as dividends, over the trailing twelve month period. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Looking at the data, we can see that Virtu Financial has been paying a dividend for the past four years. The dividend has not fluctuated much, but with a relatively short payment history, we can't be sure this is sustainable across a full market cycle. Its most recent annual dividend was US$0.96 per share, effectively flat on its first payment four years ago.

It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Virtu Financial's earnings per share have shrunk at 24% a year over the past five years. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Virtu Financial is paying out a larger percentage of its profit than we're comfortable with. Earnings per share are down, and to our mind Virtu Financial has not been paying a dividend long enough to demonstrate its resilience across economic cycles. With any dividend stock, we look for a sustainable payout ratio, steady dividends, and growing earnings. Virtu Financial has a few too many issues for us to get interested.

Given that earnings are not growing, the dividend does not look nearly so attractive. See if the 8 analysts are forecasting a turnaround in our free collection of analyst estimates here.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:VIRT

Virtu Financial

Operates as a financial services company in the United States, Ireland, and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives