- United States

- /

- Biotech

- /

- NasdaqGS:GERN

Introducing Geron (NASDAQ:GERN), The Stock That Slid 58% In The Last Five Years

Generally speaking long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example, after five long years the Geron Corporation (NASDAQ:GERN) share price is a whole 58% lower. We certainly feel for shareholders who bought near the top. Unhappily, the share price slid 1.6% in the last week.

See our latest analysis for Geron

With just US$664,000 worth of revenue in twelve months, we don't think the market considers Geron to have proven its business plan. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Geron has the funding to invent a new product before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Geron investors have already had a taste of the bitterness stocks like this can leave in the mouth.

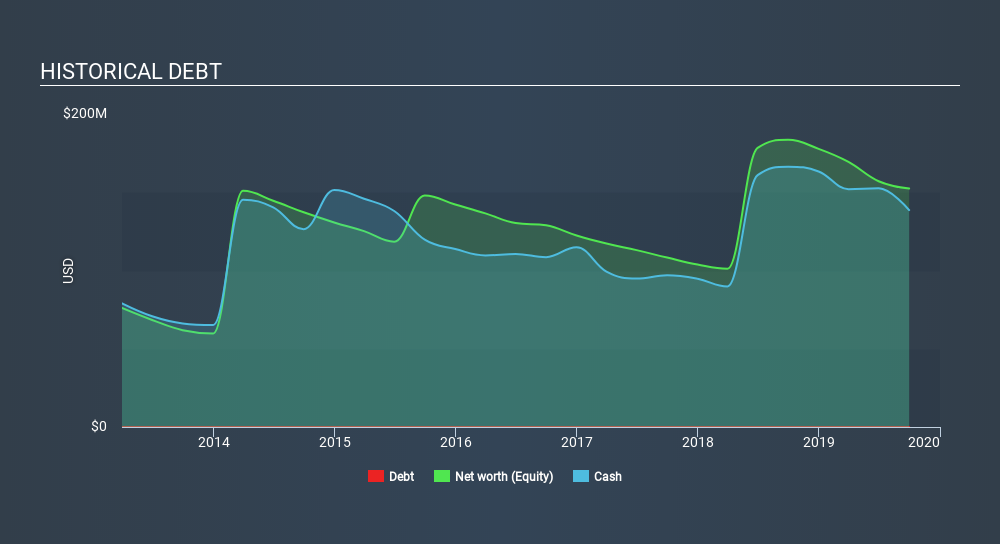

Geron has plenty of cash in the bank, with cash in excess of all liabilities sitting at US$127m, when it last reported (September 2019). That allows management to focus on growing the business, and not worry too much about raising capital. But since the share price has dropped 16% per year, over 5 years , it seems like the market might have been over-excited previously. The image below shows how Geron's balance sheet has changed over time; if you want to see the precise values, simply click on the image. The image below shows how Geron's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? It would bother me, that's for sure. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

Investors in Geron had a tough year, with a total loss of 16%, against a market gain of about 20%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 16% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Geron has 3 warning signs (and 1 which is a bit concerning) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:GERN

Geron

A commercial-stage biopharmaceutical company, focuses on the development of therapeutics products for oncology.

High growth potential and good value.

Market Insights

Community Narratives