- Germany

- /

- Diversified Financial

- /

- XTRA:CSQ

Introducing creditshelf (ETR:CSQ), The Stock That Dropped 24% In The Last Year

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in creditshelf Aktiengesellschaft (ETR:CSQ) have tasted that bitter downside in the last year, as the share price dropped 24%. That's well bellow the market return of -7.1%. We wouldn't rush to judgement on creditshelf because we don't have a long term history to look at. The falls have accelerated recently, with the share price down 11% in the last three months.

View our latest analysis for creditshelf

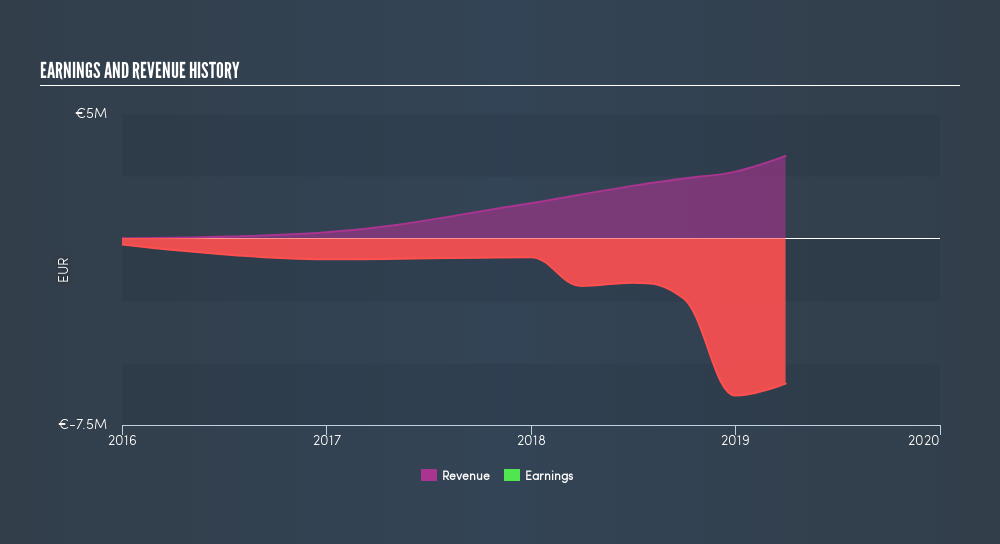

Given that creditshelf didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year creditshelf saw its revenue grow by 88%. That's a strong result which is better than most other loss making companies. The share price drop of 24% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our monkey brains haven't evolved to think exponentially, so humans do tend to underestimate companies that have exponential growth.

If you are thinking of buying or selling creditshelf stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We doubt creditshelf shareholders are happy with the loss of 24% over twelve months. That falls short of the market, which lost 7.1%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 11%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About XTRA:CSQ

creditshelf

Operates as a digital small and medium-sized enterprises financing company in Germany.

Slightly overvalued with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives