- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Strengthens Leadership Team With Key Engineering and Revenue Officer Appointments

Reviewed by Simply Wall St

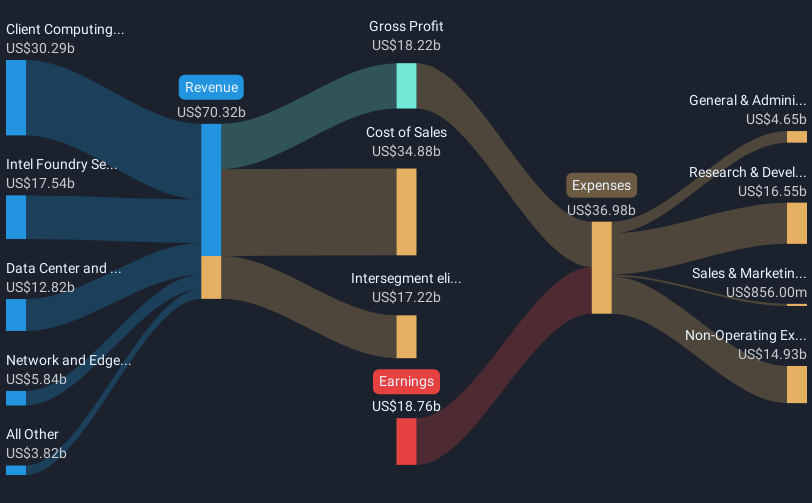

Intel (NasdaqGS:INTC) recently announced key leadership changes, including the appointments of Greg Ernst and Srinivasan Iyengar, aimed at bolstering customer relationships and engineering focus. Meanwhile, the introduction of new AI-focused products such as the Intel Arc Pro GPUs and the Gaudi 3 AI accelerators underscores the company's commitment to innovation. Despite a 4% decline in Intel's share price over the past month, broader market trends, including geopolitical tensions and anticipation of the Fed's interest rate decision, were significant factors. Intel's strategic moves may align with or counter these broader market tendencies as it positions for growth.

Buy, Hold or Sell Intel? View our complete analysis and fair value estimate and you decide.

The recent leadership changes at Intel, particularly the appointments of Greg Ernst and Srinivasan Iyengar, may provide the necessary focus on customer relations and innovation. This, coupled with the launch of new AI-focused products like the Intel Arc Pro GPUs and Gaudi 3 AI accelerators, suggests a significant push towards cutting-edge technology development. These moves could potentially offset some of the challenges Intel faces, including structural inefficiencies and manufacturing constraints. In particular, by aligning the company's operations towards AI and foundry businesses, Intel might enhance its revenue and earnings outlook, thus challenging the bearish narrative of reduced revenues and profit margins.

Over the past year, Intel's total returns, including share price and dividends, saw a decline of 31.66%. In comparison to the broader US market, which returned 9.8%, and the semiconductor industry, with a return of 1.4%, Intel underperformed. This longer-term trend indicates that despite attempts to innovate, Intel has faced significant hurdles. These challenges were reflected in a 4% decline in its share price over the past month, influenced by both internal factors and external market pressures.

The share price's proximity to the consensus price target of US$21.29, with only a minor discount, implies that analysts maintain a cautiously optimistic outlook despite the company's recent underperformance. Should Intel effectively implement its transformation strategies, the expected revenue and earnings forecasts may improve, leading to a reevaluation of its fair value. As the company works to improve profit margins and return on equity, any positive developments could gradually elevate market confidence and drive share prices closer to higher analyst price targets, mitigating the bearish scenario. However, achieving these outcomes will depend heavily on Intel's ability to overcome current operational challenges and capitalize on its AI initiatives.

Get an in-depth perspective on Intel's performance by reading our balance sheet health report here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion