- United States

- /

- Media

- /

- NasdaqGS:FOXA

Innovative Marketing Leader Joins Fox (NasdaqGS:FOXA) To Enhance Advertising Sales Strategy

Reviewed by Simply Wall St

Fox (NasdaqGS:FOXA) achieved an 8.7% price increase over the past month, likely bolstered by recent strategic developments. The appointment of Vohra as Chief Marketing Officer and Executive Vice President of Advertising Sales could have bolstered investor confidence in Fox’s growth prospects through enhanced marketing strategies. The launch of the OneFOX platform and FOX One Streaming Service introduced significant product innovations that may have been positively received by the market. Alongside broader economic trends, such as robust labor market data and gains in major indices, these initiatives appear to have aligned with the generally optimistic market sentiment in recent weeks.

Buy, Hold or Sell Fox? View our complete analysis and fair value estimate and you decide.

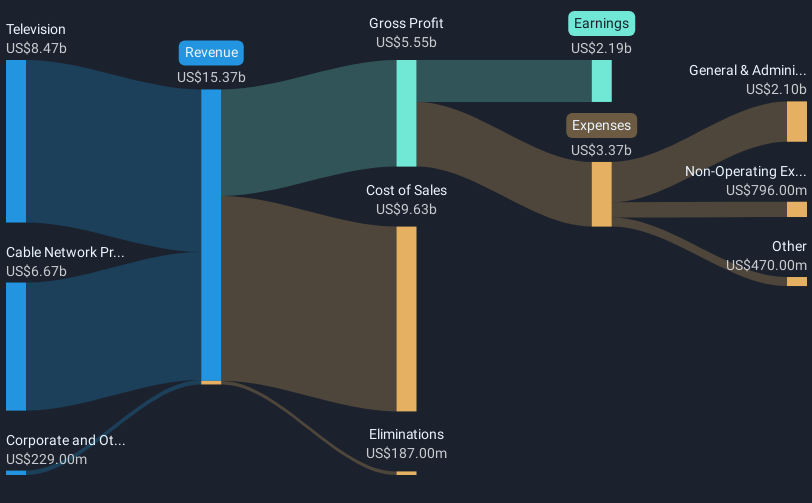

The recent developments at Fox, including the appointment of a new Chief Marketing Officer and the launch of the OneFOX platform and FOX One Streaming Service, suggest a focus on strengthening marketing strategies and product offerings. This news could influence Fox's revenue trajectory, particularly in advertising and direct-to-consumer segments, given current analyst forecasts. However, the discontinuation of the Venu joint venture may affect future affiliate revenue growth. Analysts project a 1.5% annual revenue growth over the next three years, with potential earnings reaching US$1.9 billion by April 2028. These initiatives and changes may impact Fox's earnings stability in the short term, emphasized by the mixed analyst sentiment on the company's future profitability.

Over the past five years, Fox's total shareholder return, which includes both share price appreciation and dividends, reached 105.52%, illustrating a significant longer-term gain. In comparison, the company's performance over the past year has exceeded both the US market and the US Media industry, which saw a 11.6% and 3.6% change, respectively. This relative performance places Fox in a strong position, although the broader market context and competitive pressures in sports rights remain key considerations.

Currently, Fox's share price is US$55.82, which is just 1.6% below the consensus analyst price target of US$56.72, suggesting a perception of fair valuation among analysts. These price movements, coupled with the company's earnings potential, suggest a balanced view of Fox's market position. Stakeholders are advised to consider how these developments might play into their valuation assessments and expectations for future growth.

Our valuation report unveils the possibility Fox's shares may be trading at a discount.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FOXA

Fox

Operates as a news, sports, and entertainment company in the United States (U.S.).

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives