- Hong Kong

- /

- Entertainment

- /

- SEHK:1970

IMAX China Holding, Inc. (HKG:1970) Stock Has Shown Weakness Lately But Financials Look Strong: Should Prospective Shareholders Make The Leap?

With its stock down 13% over the past three months, it is easy to disregard IMAX China Holding (HKG:1970). But if you pay close attention, you might gather that its strong financials could mean that the stock could potentially see an increase in value in the long-term, given how markets usually reward companies with good financial health. Specifically, we decided to study IMAX China Holding's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

Check out our latest analysis for IMAX China Holding

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for IMAX China Holding is:

17% = US$43m ÷ US$259m (Based on the trailing twelve months to December 2019).

The 'return' is the income the business earned over the last year. So, this means that for every HK$1 of its shareholder's investments, the company generates a profit of HK$0.17.

Why Is ROE Important For Earnings Growth?

So far, we've learnt that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

IMAX China Holding's Earnings Growth And 17% ROE

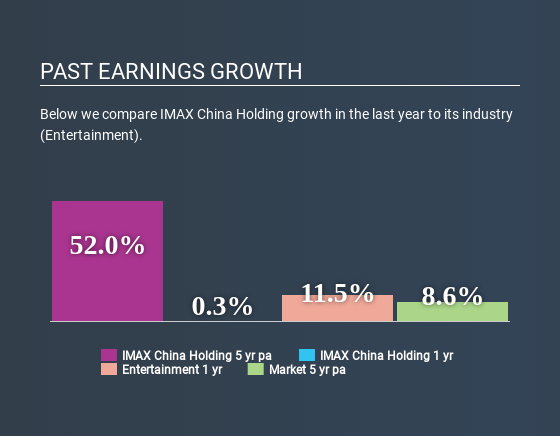

To start with, IMAX China Holding's ROE looks acceptable. On comparing with the average industry ROE of 9.5% the company's ROE looks pretty remarkable. Probably as a result of this, IMAX China Holding was able to see an impressive net income growth of 52% over the last five years. We believe that there might also be other aspects that are positively influencing the company's earnings growth. Such as - high earnings retention or an efficient management in place.

Next, on comparing with the industry net income growth, we found that IMAX China Holding's growth is quite high when compared to the industry average growth of 23% in the same period, which is great to see.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Has the market priced in the future outlook for 1970? You can find out in our latest intrinsic value infographic research report.

Is IMAX China Holding Using Its Retained Earnings Effectively?

The three-year median payout ratio for IMAX China Holding is 33%, which is moderately low. The company is retaining the remaining 67%. So it seems that IMAX China Holding is reinvesting efficiently in a way that it sees impressive growth in its earnings (discussed above) and pays a dividend that's well covered.

While IMAX China Holding has been growing its earnings, it only recently started to pay dividends which likely means that the company decided to impress new and existing shareholders with a dividend. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 31%. Therefore, the company's future ROE is also not expected to change by much with analysts predicting an ROE of 15%.

Summary

In total, we are pretty happy with IMAX China Holding's performance. In particular, it's great to see that the company is investing heavily into its business and along with a high rate of return, that has resulted in a sizeable growth in its earnings. That being so, a study of the latest analyst forecasts show that the company is expected to see a slowdown in its future earnings growth. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

When trading IMAX China Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

If you're looking to trade IMAX China Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1970

IMAX China Holding

An investment holding company, provides digital and film-based motion picture technologies in Mainland China, Hong Kong, Taiwan, and Macau.

Flawless balance sheet and good value.

Market Insights

Community Narratives