Imagine Owning Oversea-Chinese Banking (SGX:O39) And Wondering If The 19% Share Price Slide Is Justified

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. By comparison, an individual stock is unlikely to match market returns - and could well fall short. One such example is Oversea-Chinese Banking Corporation Limited (SGX:O39), which saw its share price fall 19% over a year, against a market decline of 17%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 15% in three years. It's down 19% in about a quarter. But this could be related to the weak market, which is down 20% in the same period.

View our latest analysis for Oversea-Chinese Banking

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Oversea-Chinese Banking share price fell, it actually saw its earnings per share (EPS) improve by 5.0%. It's quite possible that growth expectations may have been unreasonable in the past.

It seems quite likely that the market was expecting higher growth from the stock. But looking to other metrics might better explain the share price change.

Oversea-Chinese Banking's dividend seems healthy to us, so we doubt that the yield is a concern for the market. The revenue trend doesn't seem to explain why the share price is down. Of course, it could simply be that it simply fell short of the market consensus expectations.

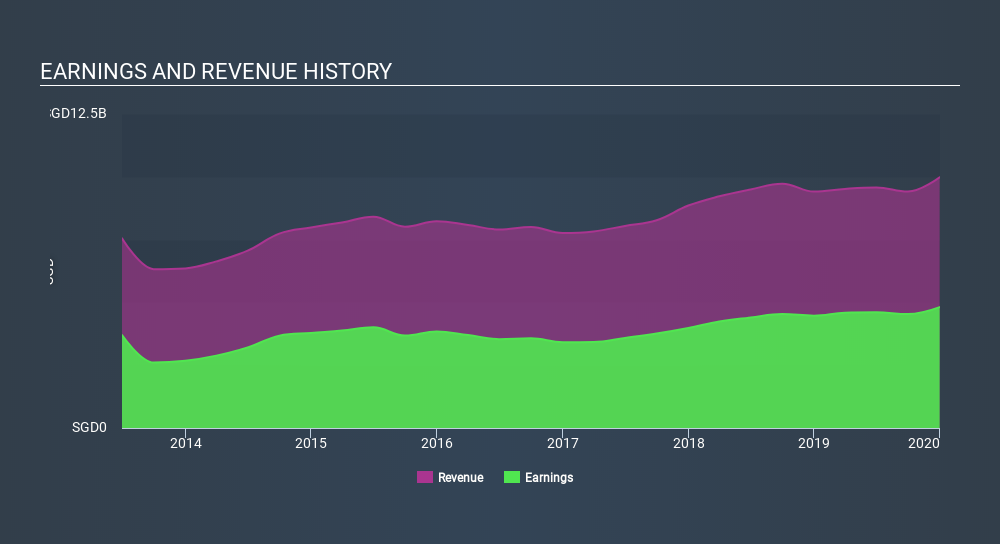

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Oversea-Chinese Banking's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Oversea-Chinese Banking's TSR, which was a 17% drop over the last year, was not as bad as the share price return.

A Different Perspective

The total return of 17% received by Oversea-Chinese Banking shareholders over the last year isn't far from the market return of -17%. The silver lining is that longer term investors would have made a total return of 0.5% per year over half a decade. If the stock price has been impacted by changing sentiment, rather than deteriorating business conditions, it could spell opportunity. It's always interesting to track share price performance over the longer term. But to understand Oversea-Chinese Banking better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Oversea-Chinese Banking you should be aware of, and 2 of them shouldn't be ignored.

Oversea-Chinese Banking is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SGX:O39

Oversea-Chinese Banking

Provides financial services in Singapore, Malaysia, Indonesia, Greater China, rest of the Asia Pacific, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives