If You Had Bought Vipshop Holdings (NYSE:VIPS) Stock Five Years Ago, You'd Be Sitting On A 60% Loss, Today

Vipshop Holdings Limited (NYSE:VIPS) shareholders are doubtless heartened to see the share price bounce 38% in just one week. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. The share price has failed to impress anyone , down a sizable 60% during that time. So we're not so sure if the recent bounce should be celebrated. But it could be that the fall was overdone.

View our latest analysis for Vipshop Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

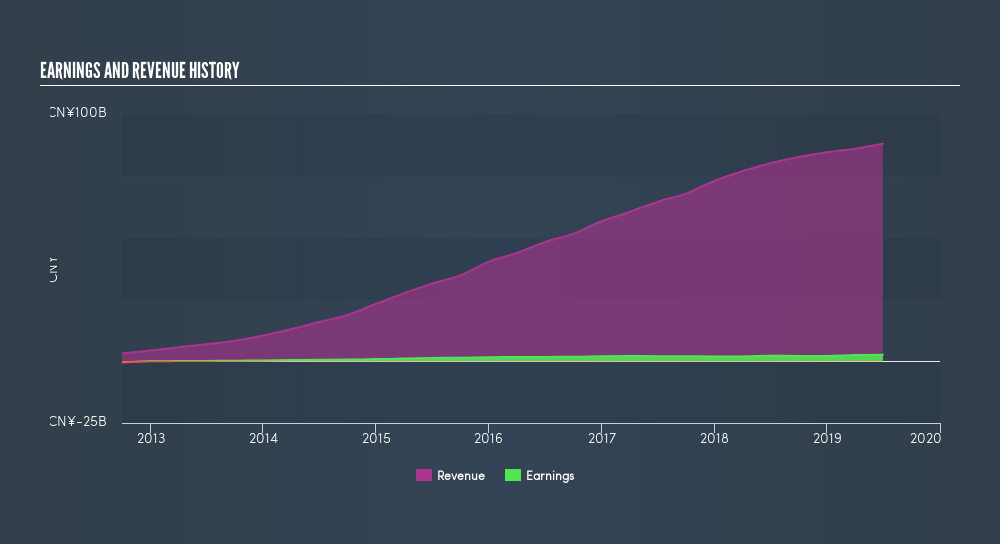

While the share price declined over five years, Vipshop Holdings actually managed to increase EPS by an average of 31% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past. Because of the sharp contrast between the EPS growth rate and the share price growth, we're inclined to look to other metrics to understand the changing market sentiment around the stock.

In contrast to the share price, revenue has actually increased by 28% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

Vipshop Holdings is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Vipshop Holdings will earn in the future (free analyst consensus estimates)

A Different Perspective

It's good to see that Vipshop Holdings has rewarded shareholders with a total shareholder return of 18% in the last twelve months. Notably the five-year annualised TSR loss of 17% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Is Vipshop Holdings cheap compared to other companies? These 3 valuation measures might help you decide.

But note: Vipshop Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:VIPS

Vipshop Holdings

Operates online platforms in the People's Republic of China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives