- United States

- /

- Software

- /

- NYSE:TYL

If You Had Bought Tyler Technologies (NYSE:TYL) Shares Five Years Ago You'd Have Made 185%

When you buy a stock there is always a possibility that it could drop 100%. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Tyler Technologies, Inc. (NYSE:TYL) share price has soared 185% in the last half decade. Most would be very happy with that. On top of that, the share price is up 18% in about a quarter. But this could be related to the strong market, which is up 11% in the last three months.

View our latest analysis for Tyler Technologies

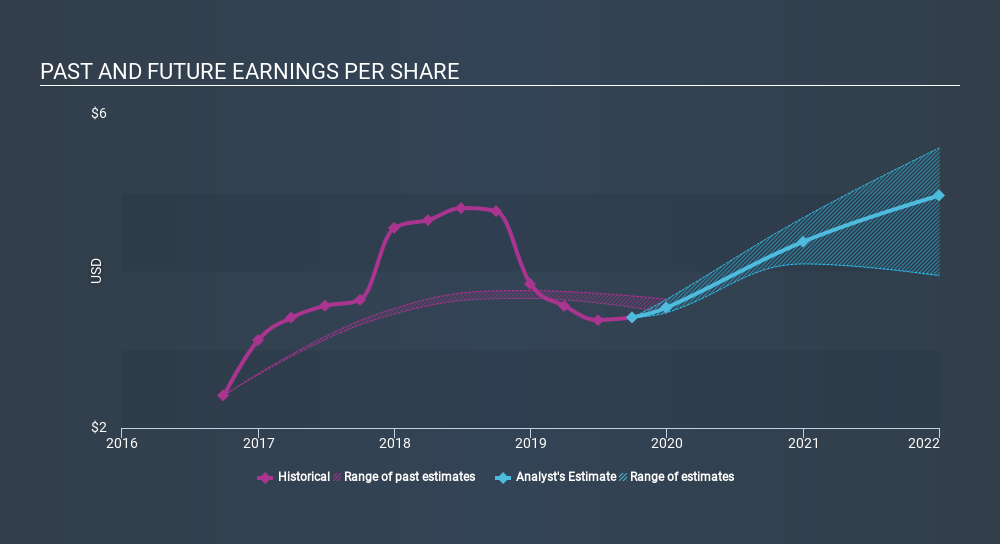

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over half a decade, Tyler Technologies managed to grow its earnings per share at 16% a year. This EPS growth is lower than the 23% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth. This optimism is visible in its fairly high P/E ratio of 90.81.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Tyler Technologies's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Tyler Technologies has rewarded shareholders with a total shareholder return of 68% in the last twelve months. That gain is better than the annual TSR over five years, which is 23%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Be aware that Tyler Technologies is showing 1 warning sign in our investment analysis , you should know about...

But note: Tyler Technologies may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:TYL

Tyler Technologies

Provides integrated software and technology management solutions for the public sector.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives