- United States

- /

- REITS

- /

- NYSE:APTS

If You Had Bought Preferred Apartment Communities (NYSE:APTS) Stock Five Years Ago, You Could Pocket A 66% Gain Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

When we invest, we're generally looking for stocks that outperform the market average. And in our experience, buying the right stocks can give your wealth a significant boost. For example, the Preferred Apartment Communities, Inc. (NYSE:APTS) share price is up 66% in the last 5 years, clearly besting than the market return of around 44% (ignoring dividends).

Check out our latest analysis for Preferred Apartment Communities

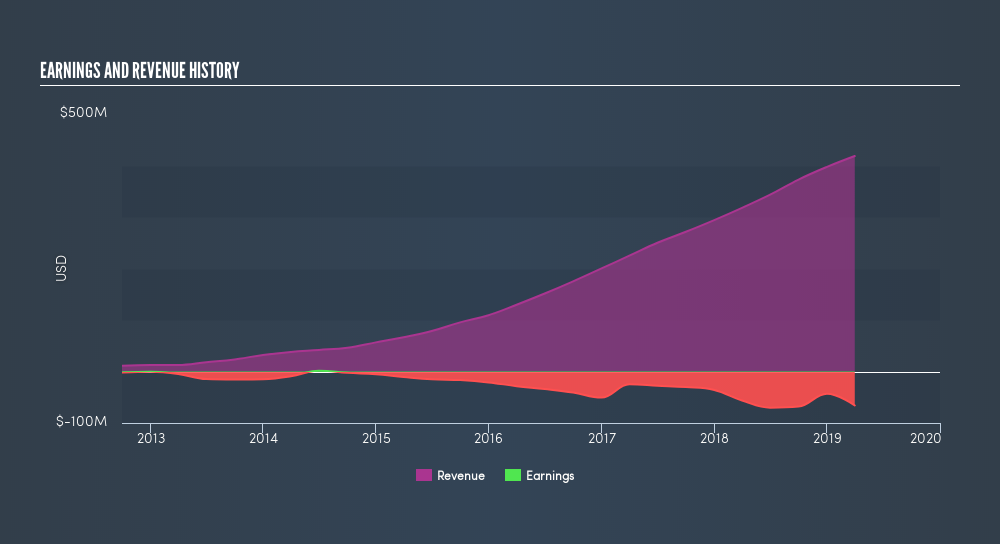

Because Preferred Apartment Communities is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

For the last half decade, Preferred Apartment Communities can boast revenue growth at a rate of 42% per year. Even measured against other revenue-focussed companies, that's a good result. It's good to see that the stock has 11%, but not entirely surprising given revenue shows strong growth. If the strong revenue growth continues, we'd expect the share price to follow, in time. Opportunity lies where the market hasn't fully priced growth in the underlying business.

Take a more thorough look at Preferred Apartment Communities's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Preferred Apartment Communities the TSR over the last 5 years was 129%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market gained around 7.1% in the last year, Preferred Apartment Communities shareholders lost 9.6% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 18%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: Preferred Apartment Communities may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:APTS

Preferred Apartment Communities

Preferred Apartment Communities, Inc. (NYSE: APTS) is a real estate investment trust engaged primarily in the ownership and operation of Class A multifamily properties, with select investments in grocery anchored shopping centers, Class A office buildings, and student housing properties.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives