- Hong Kong

- /

- Specialty Stores

- /

- SEHK:493

If You Had Bought GOME Retail Holdings (HKG:493) Stock A Year Ago, You Could Pocket A 57% Gain Today

It might be of some concern to shareholders to see the GOME Retail Holdings Limited (HKG:493) share price down 13% in the last month. But looking back over the last year, the returns have actually been rather pleasing! After all, the share price is up a market-beating 57% in that time.

See our latest analysis for GOME Retail Holdings

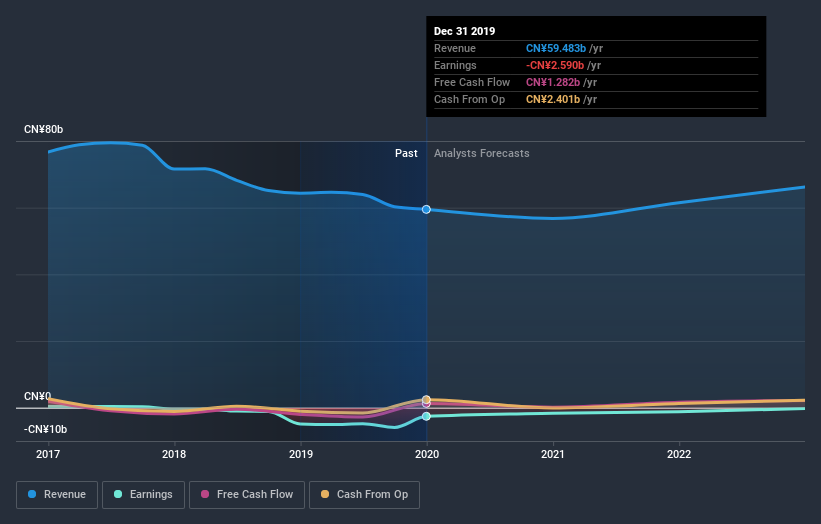

Given that GOME Retail Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

GOME Retail Holdings actually shrunk its revenue over the last year, with a reduction of 7.6%. The stock is up 57% in that time, a fine performance given the revenue drop. We can correlate the share price rise with revenue or profit growth, but it seems the market had previously expected weaker results, and sentiment around the stock is improving.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling GOME Retail Holdings stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered GOME Retail Holdings' share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that GOME Retail Holdings' TSR of 57% over the last year is better than the share price return.

A Different Perspective

We're pleased to report that GOME Retail Holdings shareholders have received a total shareholder return of 57% over one year. That certainly beats the loss of about 2.2% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand GOME Retail Holdings better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with GOME Retail Holdings , and understanding them should be part of your investment process.

But note: GOME Retail Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade GOME Retail Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:493

GOME Retail Holdings

Operates and manages retail stores in the People’s Republic of China.

Low with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives