If You Had Bought Ensurance (ASX:ENA) Stock Three Years Ago, You'd Be Sitting On A 92% Loss, Today

As every investor would know, not every swing hits the sweet spot. But you have a problem if you face massive losses more than once in a while. So take a moment to sympathize with the long term shareholders of Ensurance Limited (ASX:ENA), who have seen the share price tank a massive 92% over a three year period. That'd be enough to cause even the strongest minds some disquiet. And over the last year the share price fell 53%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 33% in the last 90 days. However, one could argue that the price has been influenced by the general market, which is down 23% in the same timeframe.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for Ensurance

Because Ensurance made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

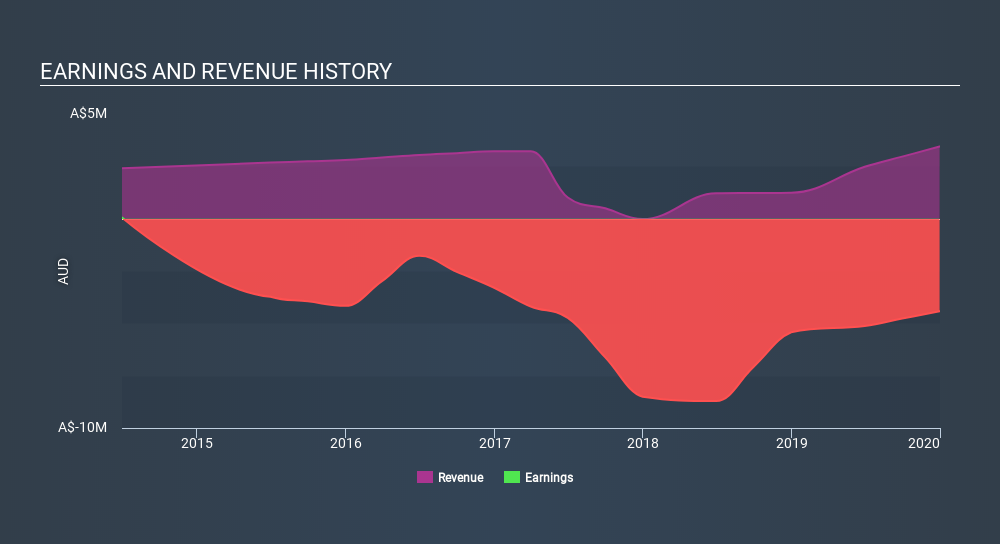

Over three years, Ensurance grew revenue at 15% per year. That's a pretty good rate of top-line growth. So it seems unlikely the 56% share price drop (each year) is entirely about the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Ensurance's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Ensurance shareholders are down 53% for the year, falling short of the market return. The market shed around 9.5%, no doubt weighing on the stock price. However, the loss over the last year isn't as bad as the 54% per annum loss investors have suffered over the last three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 6 warning signs we've spotted with Ensurance (including 4 which is shouldn't be ignored) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:ENA

Ensurance

Ensurance Limited provides customized insurance solutions in Australia and the United Kingdom.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives