- United States

- /

- Professional Services

- /

- NasdaqGS:CNDT

If You Had Bought Conduent (NASDAQ:CNDT) Stock Three Years Ago, You'd Be Sitting On A 60% Loss, Today

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. Long term Conduent Incorporated (NASDAQ:CNDT) shareholders know that all too well, since the share price is down considerably over three years. Sadly for them, the share price is down 60% in that time. And more recent buyers are having a tough time too, with a drop of 53% in the last year. Even worse, it's down 12% in about a month, which isn't fun at all.

See our latest analysis for Conduent

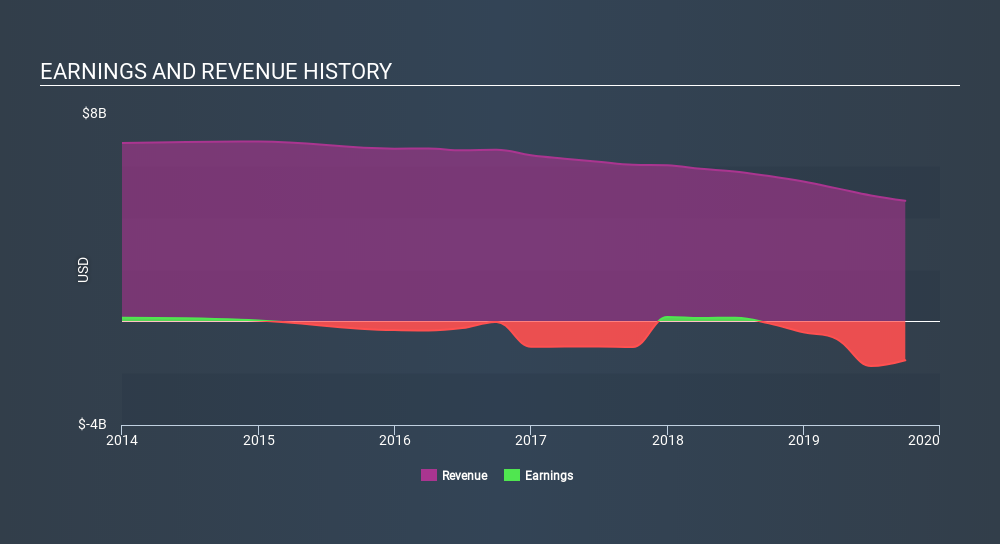

Conduent wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years Conduent saw its revenue shrink by 11% per year. That is not a good result. With revenue in decline, and profit but a dream, we can understand why the share price has been declining at 26% per year. Of course, it's the future that will determine whether today's price is a good one. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Conduent stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Conduent shareholders are down 53% for the year, but the broader market is up 26%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 26% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Conduent you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:CNDT

Conduent

Provides digital business solutions and services for the commercial, government, and transportation spectrum in the United States, Europe, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives