- United States

- /

- Tech Hardware

- /

- NasdaqGS:AAPL

If You Had Bought Apple (NASDAQ:AAPL) Shares Three Years Ago You'd Have Made 145%

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But when you pick a company that is really flourishing, you can make more than 100%. To wit, the Apple Inc. (NASDAQ:AAPL) share price has flown 145% in the last three years. How nice for those who held the stock! On top of that, the share price is up 29% in about a quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

See our latest analysis for Apple

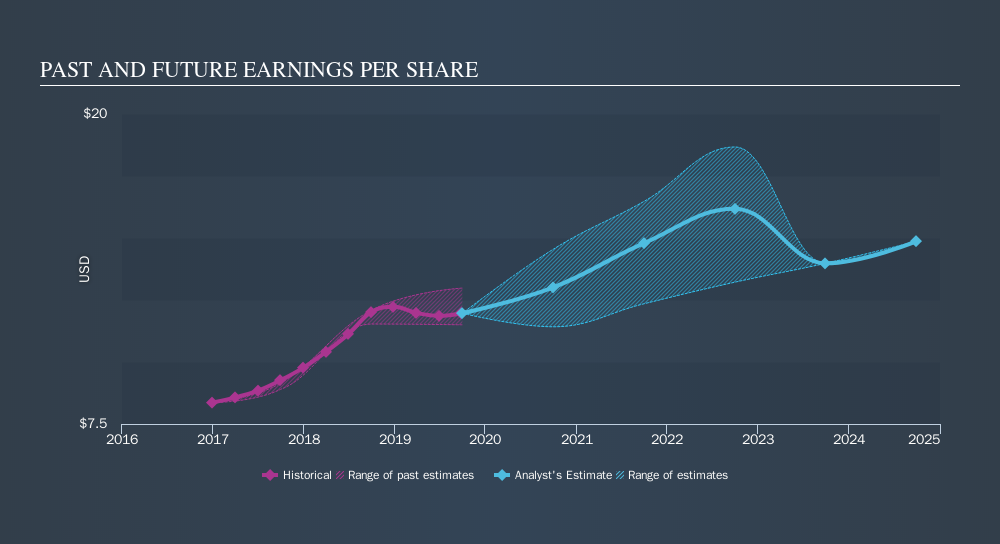

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Apple was able to grow its EPS at 13% per year over three years, sending the share price higher. This EPS growth is lower than the 35% average annual increase in the share price. This suggests that, as the business progressed over the last few years, it gained the confidence of market participants. It's not unusual to see the market 're-rate' a stock, after a few years of growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Apple's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Apple the TSR over the last 3 years was 156%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Apple has rewarded shareholders with a total shareholder return of 38% in the last twelve months. Of course, that includes the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 20% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:AAPL

Apple

Designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives