- United States

- /

- Hospitality

- /

- NasdaqGS:RUTH

I Built A List Of Growing Companies And Ruth's Hospitality Group (NASDAQ:RUTH) Made The Cut

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Ruth's Hospitality Group (NASDAQ:RUTH). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Ruth's Hospitality Group

Ruth's Hospitality Group's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. We can see that in the last three years Ruth's Hospitality Group grew its EPS by 16% per year. That's a good rate of growth, if it can be sustained.

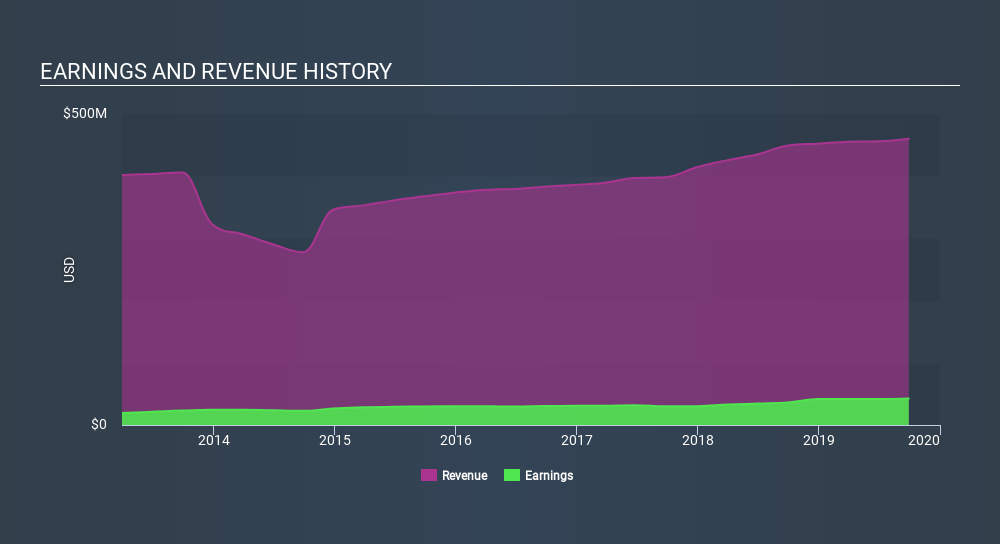

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Ruth's Hospitality Group maintained stable EBIT margins over the last year, all while growing revenue 2.5% to US$460m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Ruth's Hospitality Group?

Are Ruth's Hospitality Group Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Ruth's Hospitality Group shares worth a considerable sum. Indeed, they hold US$46m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 7.4% of the company; visible skin in the game.

Does Ruth's Hospitality Group Deserve A Spot On Your Watchlist?

One important encouraging feature of Ruth's Hospitality Group is that it is growing profits. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Ruth's Hospitality Group is trading on a high P/E or a low P/E, relative to its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:RUTH

Ruth's Hospitality Group

Ruth's Hospitality Group, Inc., together with its subsidiaries, develops, operates, and franchises fine dining restaurants under the Ruth’s Chris Steak House name.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives