- United States

- /

- Banks

- /

- NasdaqGS:HBAN

Huntington Bancshares (NasdaqGS:HBAN) Acquires Veritex Holdings for Strategic Expansion

Reviewed by Simply Wall St

Huntington Bancshares (NasdaqGS:HBAN) gained 30% last quarter, a significant increase in a period marked by its acquisition of Veritex Holdings, which may reshape its growth trajectory. This acquisition could be seen as aligning with investors' bullish sentiment as major stock indices neared record highs despite trade policy uncertainties. Additionally, Huntington's strong Q1 earnings, highlighted by a rise in net interest income and net income, likely supported its positive performance. The company's share buyback plan and steady dividends might have further added to the positive sentiment in a market that remained mostly flat during this time.

You should learn about the 1 warning sign we've spotted with Huntington Bancshares.

The recent acquisition by Huntington Bancshares of Veritex Holdings may reshape the company's growth trajectory by expanding its footprint. This expansion aligns with Huntington's investments in talent and regional growth in the Carolinas and Texas, potentially driving increased loans, deposits, and revenue. Over the past five years, Huntington Bancshares achieved a total return, including share price appreciation and dividends, of 151.02%, highlighting robust long-term performance. In the past year alone, Huntington Bancshares outperformed the US Market, which had an 11.4% increase, and the US Banks industry, which saw a 24.5% increase.

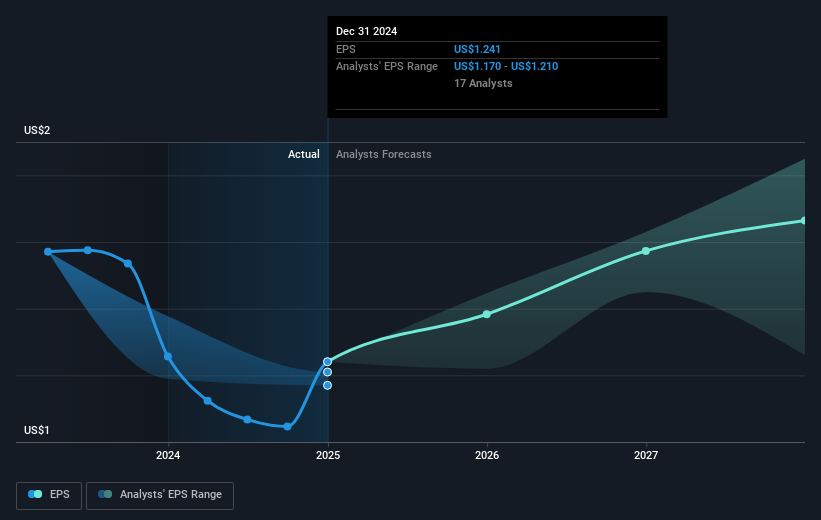

The acquisition and strategic expansions may bolster revenue forecasts by enhancing high-fee revenue areas and strengthening net interest margins. Analysts estimate revenue to grow at an annual rate of 6.7% over the upcoming years, supported by Huntington's disciplined approach to deposit pricing. Earnings are anticipated to rise from US$1.92 billion to US$2.3 billion by 2028, with cautious optimism despite economic uncertainties. Although the company's current share price of US$14.88 reflects a discount to the consensus price target of US$19.02, the expected improvements in earnings per share, supported by share buybacks, provide a potential pathway towards this target. Given these factors, investors may continue to monitor how effectively Huntington Bancshares navigates competitive pressures and economic uncertainties, which could impact its revenue and earnings trajectory.

Evaluate Huntington Bancshares' historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huntington Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HBAN

Huntington Bancshares

Operates as the bank holding company for The Huntington National Bank that provides commercial, consumer, and mortgage banking services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives