- United States

- /

- Healthcare Services

- /

- NYSE:HUM

Humana (NYSE:HUM) Expands Medicaid Options Through Virginia Cardinal Care Partnership

Reviewed by Simply Wall St

Humana (NYSE:HUM) has recently introduced Humana Healthy Horizons, a new Medicaid plan for Virginians under Cardinal Care, highlighting its focus on expanding in the Medicaid sector. This move underscores Humana's strategic growth amid a market environment where major indexes, including the S&P 500 and Nasdaq, reached record highs. During the last month, despite broader market gains and significant employment data, Humana's stock rose 5%, which aligns with the upward market trajectory, although the new Medicaid plan and sustainability initiatives may have reinforced investor sentiment. The company's steady performance reflects confidence in its ongoing healthcare and sustainability goals.

Buy, Hold or Sell Humana? View our complete analysis and fair value estimate and you decide.

The recent introduction of Humana Healthy Horizons in Virginia aligns with Humana's continued focus on expanding its Medicaid services, which will likely enhance revenue and earnings potential. While the company’s stock increased by 5% over the past month, it is crucial to note its longer-term performance. Over the past year, Humana's total return, including dividends, was 31.92%, despite the US healthcare industry facing a 20% decline during the same period. This resilience suggests underlying investor confidence tied to Humana’s growth and operational strategies.

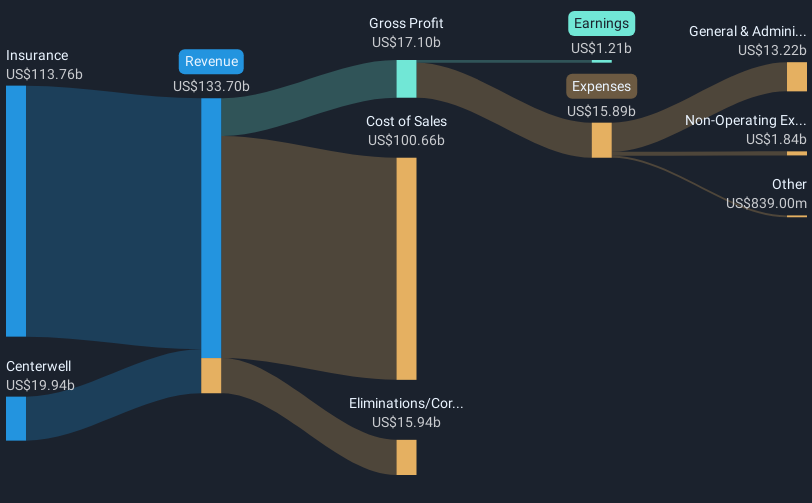

Looking ahead, Humana's initiatives in AI and primary care could bolster cost efficiencies and elevate customer experiences, promoting margin enhancement. The revenue forecast suggests a growth rate of about 5.9% annually, with earnings expected to reach US$2.7 billion by 2028. However, these growth assumptions incorporate potential uncertainties in regulatory impacts and operational challenges.

With a current share price of US$251.77, the analyst consensus price target of US$309.40 represents an 18.6% potential upside. This target assumes the successful implementation of growth initiatives and improved profit margins. Investors should weigh these forecasts against Humana's operational execution and external risks to form their own investment outlook.

Review our growth performance report to gain insights into Humana's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Humana might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUM

Humana

Provides medical and specialty insurance products in the United States.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives