Huhtamaki PPL Limited (NSE:PAPERPROD) Vies For A Place In Your Dividend Portfolio: Here's Why

Is Huhtamaki PPL Limited (NSE:PAPERPROD) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

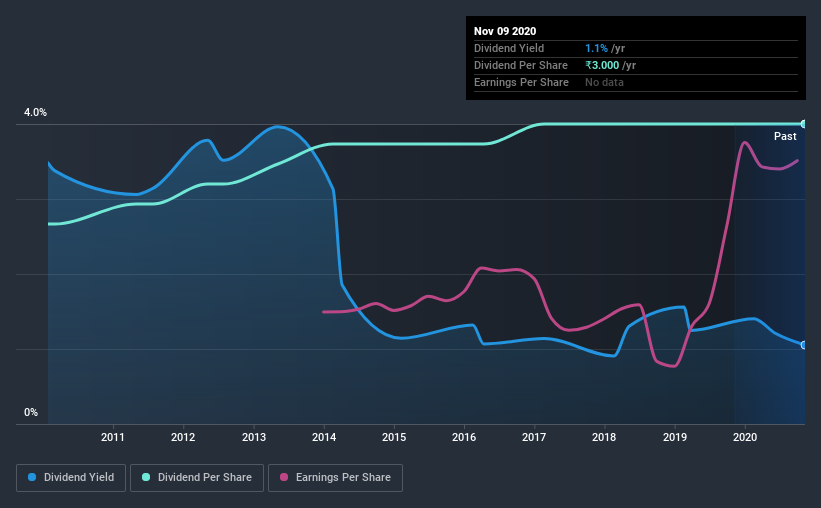

A slim 1.1% yield is hard to get excited about, but the long payment history is respectable. At the right price, or with strong growth opportunities, Huhtamaki PPL could have potential. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Huhtamaki PPL paid out 14% of its profit as dividends, over the trailing twelve month period. Given the low payout ratio, it is hard to envision the dividend coming under threat, barring a catastrophe.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Of the free cash flow it generated last year, Huhtamaki PPL paid out 26% as dividends, suggesting the dividend is affordable. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Consider getting our latest analysis on Huhtamaki PPL's financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. For the purpose of this article, we only scrutinise the last decade of Huhtamaki PPL's dividend payments. During this period the dividend has been stable, which could imply the business could have relatively consistent earnings power. During the past 10-year period, the first annual payment was ₹2.0 in 2010, compared to ₹3.0 last year. Dividends per share have grown at approximately 4.1% per year over this time.

While the consistency in the dividend payments is impressive, we think the relatively slow rate of growth is unappealing.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. It's good to see Huhtamaki PPL has been growing its earnings per share at 18% a year over the past five years. Earnings per share are growing at a solid clip, and the payout ratio is low. We think this is an ideal combination in a dividend stock.

Conclusion

To summarise, shareholders should always check that Huhtamaki PPL's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. It's great to see that Huhtamaki PPL is paying out a low percentage of its earnings and cash flow. That said, we were glad to see it growing earnings and paying a fairly consistent dividend. Huhtamaki PPL has met all of our criteria, including having strong cash flow that covers the dividend. We definitely think it would be worthwhile looking closer.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Now, if you want to look closer, it would be worth checking out our free research on Huhtamaki PPL management tenure, salary, and performance.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you decide to trade Huhtamaki PPL, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Huhtamaki India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:HUHTAMAKI

Huhtamaki India

Engages in the manufacture and sale of flexible consumer packaging and labelling solutions in India.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives