- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:ITRI

How Should Investors Feel About Itron, Inc.'s (NASDAQ:ITRI) CEO Pay?

Philip Mezey became the CEO of Itron, Inc. (NASDAQ:ITRI) in 2013. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. After that, we will consider the growth in the business. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

Check out our latest analysis for Itron

How Does Philip Mezey's Compensation Compare With Similar Sized Companies?

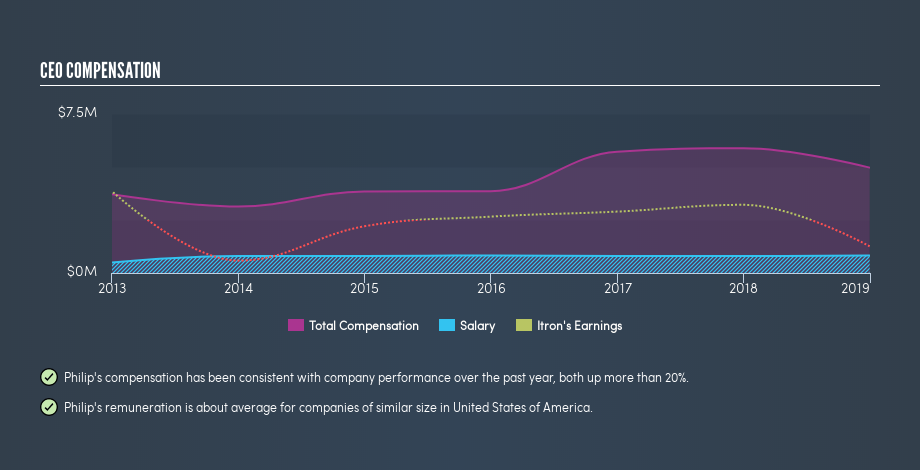

At the time of writing our data says that Itron, Inc. has a market cap of US$2.5b, and is paying total annual CEO compensation of US$5.0m. (This number is for the twelve months until December 2018). While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at US$821k. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of US$2.0b to US$6.4b. The median total CEO compensation was US$5.1m.

So Philip Mezey receives a similar amount to the median CEO pay, amongst the companies we looked at. This doesn't tell us a whole lot on its own, but looking at the performance of the actual business will give us useful context.

You can see a visual representation of the CEO compensation at Itron, below.

Is Itron, Inc. Growing?

Over the last three years Itron, Inc. has shrunk its earnings per share by an average of 67% per year (measured with a line of best fit). In the last year, its revenue is up 11%.

Unfortunately, earnings per share have trended lower over the last three years. There's no doubt that the silver lining is that revenue is up. But it isn't sufficiently fast growth to overlook the fact that earnings per share has gone backwards over three years. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO.

Has Itron, Inc. Been A Good Investment?

I think that the total shareholder return of 47%, over three years, would leave most Itron, Inc. shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Philip Mezey is paid around what is normal the leaders of comparable size companies.

We feel that earnings per share have been a bit disappointing, but it's nice to see positive shareholder returns over the last three years. So we think most shareholders wouldn't be too worried about CEO compensation, which is close to the median for similar sized companies. If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Itron.

Important note: Itron may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:ITRI

Itron

A technology, solutions, and service company, provides end-to-end solutions that help manage energy, water, and smart city operations worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion