- United Kingdom

- /

- Basic Materials

- /

- LSE:FORT

How Should Investors Feel About Forterra's (LON:FORT) CEO Remuneration?

Stephen Harrison has been the CEO of Forterra plc (LON:FORT) since 2016, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Forterra.

See our latest analysis for Forterra

How Does Total Compensation For Stephen Harrison Compare With Other Companies In The Industry?

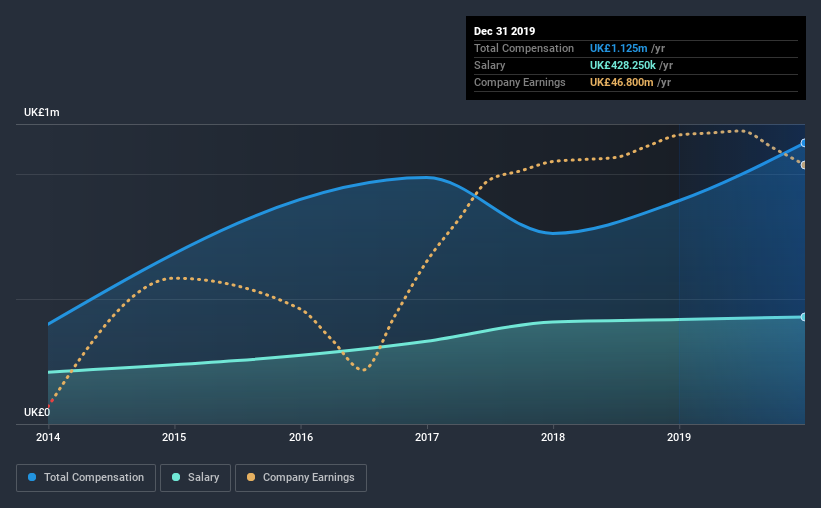

At the time of writing, our data shows that Forterra plc has a market capitalization of UK£376m, and reported total annual CEO compensation of UK£1.1m for the year to December 2019. Notably, that's an increase of 26% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at UK£428k.

On examining similar-sized companies in the industry with market capitalizations between UK£153m and UK£610m, we discovered that the median CEO total compensation of that group was UK£410k. This suggests that Stephen Harrison is paid more than the median for the industry. Moreover, Stephen Harrison also holds UK£241k worth of Forterra stock directly under their own name.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | UK£428k | UK£418k | 38% |

| Other | UK£696k | UK£475k | 62% |

| Total Compensation | UK£1.1m | UK£893k | 100% |

On an industry level, around 40% of total compensation represents salary and 60% is other remuneration. Although there is a difference in how total compensation is set, Forterra more or less reflects the market in terms of setting the salary. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Forterra plc's Growth

Over the past three years, Forterra plc has seen its earnings per share (EPS) grow by 20% per year. It achieved revenue growth of 3.4% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Forterra plc Been A Good Investment?

Since shareholders would have lost about 33% over three years, some Forterra plc investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As we touched on above, Forterra plc is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. However, the EPS growth is certainly impressive, but it's disappointing to see negative shareholder returns over the same period. Considering overall performance, we can't say Stephen is underpaid, in fact compensation is definitely on the higher side.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 4 warning signs for Forterra (1 shouldn't be ignored!) that you should be aware of before investing here.

Switching gears from Forterra, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Forterra, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:FORT

Forterra

Engages in the manufacturing and sale of building products made from clay and concrete in the United Kingdom.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives