- India

- /

- Metals and Mining

- /

- NSEI:CENTEXT

How Much is Century Extrusions' (NSE:CENTEXT) CEO Getting Paid?

Vikram Jhunjhunwala became the CEO of Century Extrusions Limited (NSE:CENTEXT) in 2016, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Century Extrusions.

View our latest analysis for Century Extrusions

How Does Total Compensation For Vikram Jhunjhunwala Compare With Other Companies In The Industry?

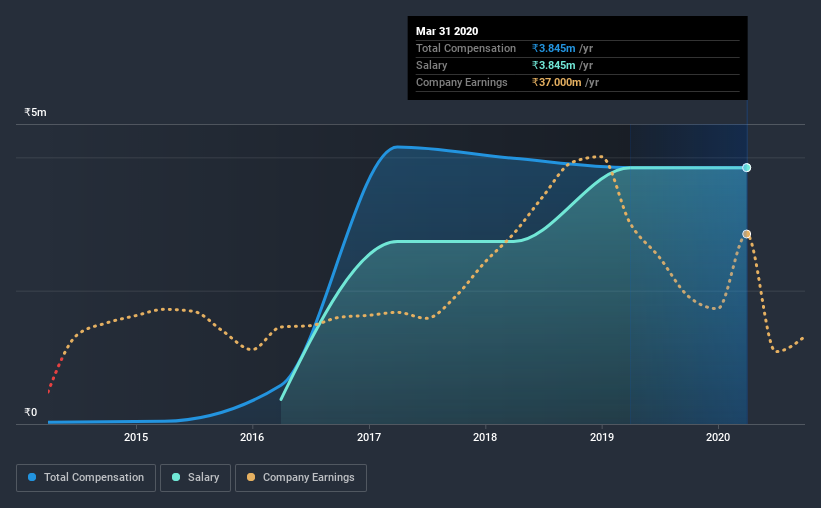

At the time of writing, our data shows that Century Extrusions Limited has a market capitalization of ₹269m, and reported total annual CEO compensation of ₹3.8m for the year to March 2020. This means that the compensation hasn't changed much from last year. Notably, the salary of ₹3.8m is the entirety of the CEO compensation.

For comparison, other companies in the industry with market capitalizations below ₹15b, reported a median total CEO compensation of ₹6.2m. This suggests that Vikram Jhunjhunwala is paid below the industry median. What's more, Vikram Jhunjhunwala holds ₹11m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Speaking on an industry level, nearly 94% of total compensation represents salary, while the remainder of 6.1% is other remuneration. Speaking on a company level, Century Extrusions prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Century Extrusions Limited's Growth

Over the last three years, Century Extrusions Limited has shrunk its earnings per share by 31% per year. It saw its revenue drop 23% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Century Extrusions Limited Been A Good Investment?

Since shareholders would have lost about 27% over three years, some Century Extrusions Limited investors would surely be feeling negative emotions. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

Century Extrusions rewards its CEO solely through a salary, ignoring non-salary benefits completely. As we touched on above, Century Extrusions Limited is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Over the last three years, shareholder returns have been downright disappointing, and EPSgrowth has been equally disappointing. Although we wouldn’t say CEO compensation is high, it’s tough to foresee shareholders warming up to thoughts of a bump anytime soon.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 4 warning signs (and 2 which are a bit concerning) in Century Extrusions we think you should know about.

Switching gears from Century Extrusions, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Century Extrusions, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:CENTEXT

Century Extrusions

Manufactures and sells aluminum extrusion products in India.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

The Campbell’s Company (CPB): Guidance Slashed as Snacks Weakness and Winter Storms Create a Perfect Storm

Strategic pivot in maximizing corporate value

Buy-out proposal for BARK Inc., at $1.10 has be confirmed by the acquisition group

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks