- Hong Kong

- /

- Semiconductors

- /

- SEHK:981

How Financially Strong Is Semiconductor Manufacturing International Corporation (HKG:981)?

Small-caps and large-caps are wildly popular among investors, however, mid-cap stocks, such as Semiconductor Manufacturing International Corporation (HKG:981), with a market capitalization of HK$39b, rarely draw their attention from the investing community. However, history shows that overlooked mid-cap companies have performed better on a risk-adjusted manner than the smaller and larger segment of the market. 981’s financial liquidity and debt position will be analysed in this article, to get an idea of whether the company can fund opportunities for strategic growth and maintain strength through economic downturns. Remember this is a very top-level look that focuses exclusively on financial health, so I recommend a deeper analysis into 981 here.

View our latest analysis for Semiconductor Manufacturing International

Does 981 Produce Much Cash Relative To Its Debt?

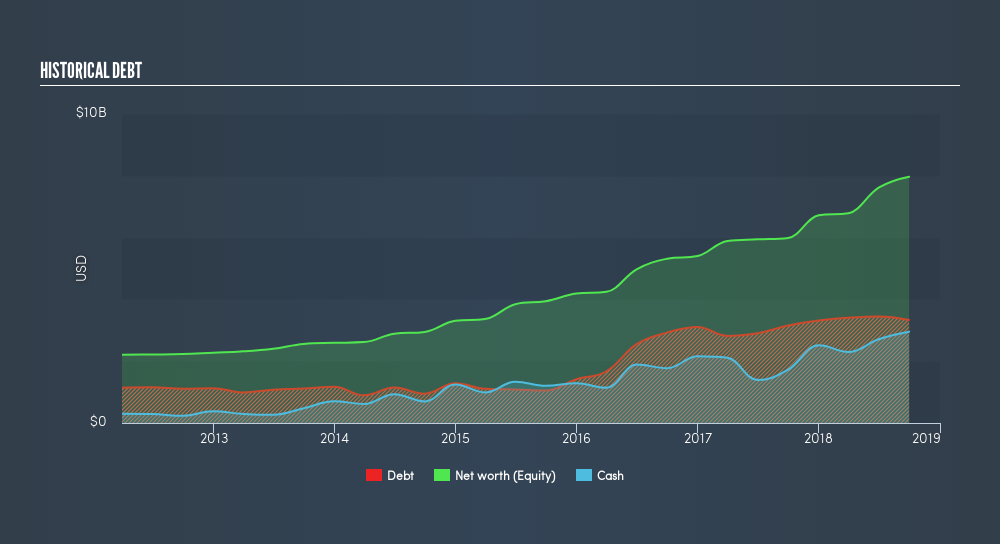

Over the past year, 981 has ramped up its debt from US$3.2b to US$3.3b , which accounts for long term debt. With this rise in debt, 981 currently has US$3.0b remaining in cash and short-term investments to keep the business going. Additionally, 981 has generated US$691m in operating cash flow over the same time period, leading to an operating cash to total debt ratio of 21%, indicating that 981’s debt is appropriately covered by operating cash.

Can 981 pay its short-term liabilities?

Looking at 981’s US$2.5b in current liabilities, the company has been able to meet these commitments with a current assets level of US$5.2b, leading to a 2.1x current account ratio. The current ratio is the number you get when you divide current assets by current liabilities. Usually, for Semiconductor companies, this is a suitable ratio since there's a sufficient cash cushion without leaving too much capital idle or in low-earning investments.

Is 981’s debt level acceptable?

With debt reaching 42% of equity, 981 may be thought of as relatively highly levered. This is not uncommon for a mid-cap company given that debt tends to be lower-cost and at times, more accessible.

Next Steps:

Although 981’s debt level is towards the higher end of the spectrum, its cash flow coverage seems adequate to meet obligations which means its debt is being efficiently utilised. This may mean this is an optimal capital structure for the business, given that it is also meeting its short-term commitment. Keep in mind I haven't considered other factors such as how 981 has been performing in the past. I suggest you continue to research Semiconductor Manufacturing International to get a better picture of the mid-cap by looking at:

- Future Outlook: What are well-informed industry analysts predicting for 981’s future growth? Take a look at our free research report of analyst consensus for 981’s outlook.

- Historical Performance: What has 981's returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:981

Semiconductor Manufacturing International

An investment holding company, engages in the manufacture, testing, and sale of integrated circuits wafer and various compound semiconductors in the United States, China, and Eurasia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives