- United Kingdom

- /

- Hospitality

- /

- LSE:FSTA

How Does Fuller Smith & Turner's (LON:FSTA) P/E Compare To Its Industry, After The Share Price Drop?

To the annoyance of some shareholders, Fuller Smith & Turner (LON:FSTA) shares are down a considerable 30% in the last month. Indeed the recent decline has arguably caused some bitterness for shareholders who have held through the 42% drop over twelve months.

All else being equal, a share price drop should make a stock more attractive to potential investors. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). So, on certain occasions, long term focussed investors try to take advantage of pessimistic expectations to buy shares at a better price. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). A high P/E implies that investors have high expectations of what a company can achieve compared to a company with a low P/E ratio.

Check out our latest analysis for Fuller Smith & Turner

Does Fuller Smith & Turner Have A Relatively High Or Low P/E For Its Industry?

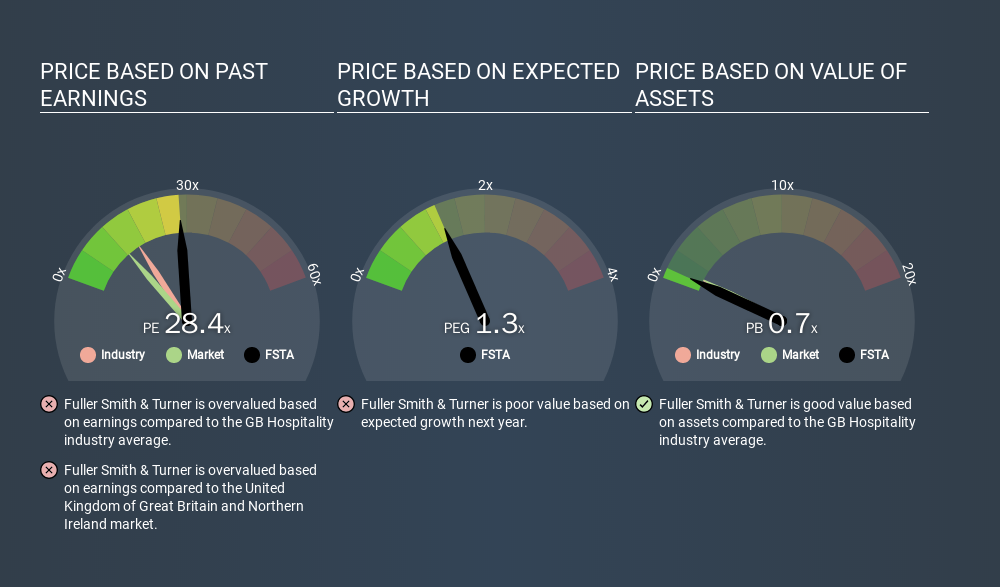

Fuller Smith & Turner's P/E of 28.38 indicates some degree of optimism towards the stock. As you can see below, Fuller Smith & Turner has a higher P/E than the average company (15.3) in the hospitality industry.

Fuller Smith & Turner's P/E tells us that market participants think the company will perform better than its industry peers, going forward. Shareholders are clearly optimistic, but the future is always uncertain. So further research is always essential. I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

When earnings fall, the 'E' decreases, over time. That means even if the current P/E is low, it will increase over time if the share price stays flat. A higher P/E should indicate the stock is expensive relative to others -- and that may encourage shareholders to sell.

Fuller Smith & Turner saw earnings per share decrease by 44% last year. And EPS is down 14% a year, over the last 5 years. This growth rate might warrant a below average P/E ratio.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

The 'Price' in P/E reflects the market capitalization of the company. Thus, the metric does not reflect cash or debt held by the company. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

Is Debt Impacting Fuller Smith & Turner's P/E?

Fuller Smith & Turner has net debt worth just 7.0% of its market capitalization. So it doesn't have as many options as it would with net cash, but its debt would not have much of an impact on its P/E ratio.

The Verdict On Fuller Smith & Turner's P/E Ratio

Fuller Smith & Turner's P/E is 28.4 which is above average (11.9) in its market. With a bit of debt, but a lack of recent growth, it's safe to say the market is expecting improved profit performance from the company, in the next few years. What can be absolutely certain is that the market has become significantly less optimistic about Fuller Smith & Turner over the last month, with the P/E ratio falling from 40.6 back then to 28.4 today. For those who don't like to trade against momentum, that could be a warning sign, but a contrarian investor might want to take a closer look.

When the market is wrong about a stock, it gives savvy investors an opportunity. People often underestimate remarkable growth -- so investors can make money when fast growth is not fully appreciated. So this free report on the analyst consensus forecasts could help you make a master move on this stock.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About LSE:FSTA

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives