- India

- /

- Paper and Forestry Products

- /

- NSEI:EMAMIPAP

How Did Emami Paper Mills Limited's (NSE:EMAMIPAP) 8.7% ROE Fare Against The Industry?

One of the best investments we can make is in our own knowledge and skill set. With that in mind, this article will work through how we can use Return On Equity (ROE) to better understand a business. We'll use ROE to examine Emami Paper Mills Limited (NSE:EMAMIPAP), by way of a worked example.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Emami Paper Mills

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Emami Paper Mills is:

8.7% = ₹214m ÷ ₹2.5b (Based on the trailing twelve months to December 2019).

The 'return' is the income the business earned over the last year. One way to conceptualize this is that for each ₹1 of shareholders' capital it has, the company made ₹0.09 in profit.

Does Emami Paper Mills Have A Good Return On Equity?

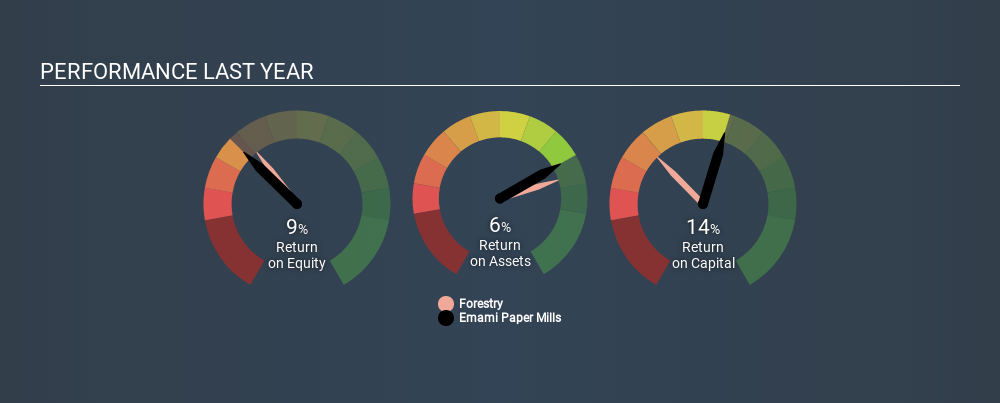

By comparing a company's ROE with its industry average, we can get a quick measure of how good it is. Importantly, this is far from a perfect measure, because companies differ significantly within the same industry classification. You can see in the graphic below that Emami Paper Mills has an ROE that is fairly close to the average for the Forestry industry (9.2%).

So while the ROE is not exceptional, at least its acceptable. Although the ROE is similar to the industry, we should still perform further checks to see if the company's ROE is being boosted by high debt levels. If a company takes on too much debt, it is at higher risk of defaulting on interest payments. Our risks dashboardshould have the 5 risks we have identified for Emami Paper Mills.

How Does Debt Impact ROE?

Most companies need money -- from somewhere -- to grow their profits. That cash can come from issuing shares, retained earnings, or debt. In the first two cases, the ROE will capture this use of capital to grow. In the latter case, the debt required for growth will boost returns, but will not impact the shareholders' equity. Thus the use of debt can improve ROE, albeit along with extra risk in the case of stormy weather, metaphorically speaking.

Emami Paper Mills' Debt And Its 8.7% ROE

It appears that Emami Paper Mills makes extensive use of debt to improve its returns, because it has an alarmingly high debt to equity ratio of 5.98. The combination of a rather low ROE and high debt to equity is a negative, in our book.

Summary

Return on equity is useful for comparing the quality of different businesses. In our books, the highest quality companies have high return on equity, despite low debt. If two companies have the same ROE, then I would generally prefer the one with less debt.

But when a business is high quality, the market often bids it up to a price that reflects this. Profit growth rates, versus the expectations reflected in the price of the stock, are a particularly important to consider. You can see how the company has grow in the past by looking at this FREE detailed graph of past earnings, revenue and cash flow.

But note: Emami Paper Mills may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

If you’re looking to trade Emami Paper Mills, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

If you're looking to trade Emami Paper Mills, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Emami Paper Mills might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:EMAMIPAP

Emami Paper Mills

Manufactures and sells paper and paper board products in India.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives