- United States

- /

- Industrials

- /

- NasdaqGS:HON

Honeywell International (NasdaqGS:HON) Appoints Jim Masso to Lead Process Automation Business

Reviewed by Simply Wall St

Honeywell International (NasdaqGS:HON) recently appointed Jim Masso as President and CEO of its Process Automation unit, a move coinciding with a 31% share price increase over the last quarter, suggesting confidence in its leadership and strategic direction. Recent announcements, including a $2.41 billion acquisition target, new technology alliances, and an AI platform launch, further underscore its commitment to innovation and growth. While the broader market remains relatively stable amid trade uncertainties, Honeywell's activities, such as the successful completion of a sizable share buyback, may have added weight to its positive momentum despite index re-shufflings.

The recent appointment of Jim Masso and Honeywell's strategic initiatives, including the $2.41 billion acquisition target and AI platform launch, signal a proactive approach toward growth despite broader market stability. Such decisions may impact Honeywell's narrative by highlighting the company's focus on enhancing its automation sector. Over the past five years, the company's total return, including share price and dividends, was 84.56%, demonstrating a solid performance. However, relative to the industrial sector over the past year, Honeywell falls short, with the industry returning 20.8% while the company did not achieve the same level of return.

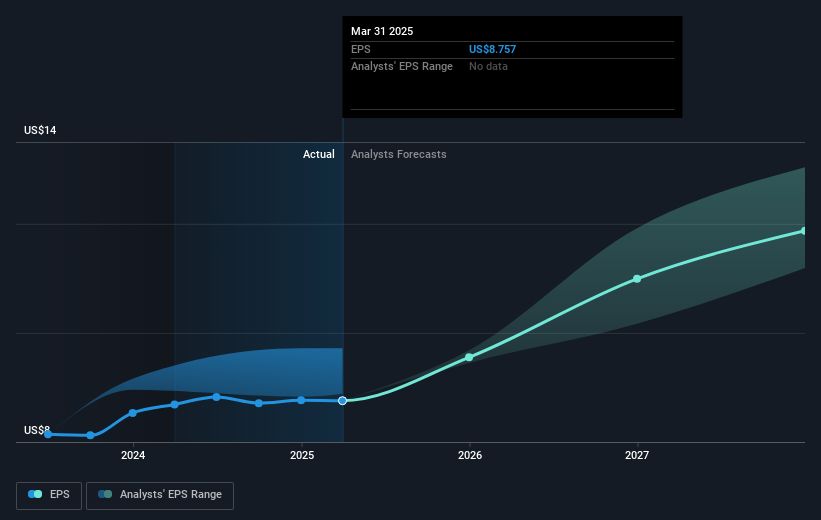

These recent developments could influence revenue and earnings forecasts by potentially increasing sales through innovations and strategic alignments. However, the impacts of tariffs and separations into three companies present risks, particularly in execution and initial costs estimated between $1.5 billion to $2 billion. This division may pressure near-term earnings yet aims to boost shareholder value long term. The current share price of US$209.93 closely approaches analysts' consensus price target of US$243.27, representing a modest discount. The implications of Honeywell's initiatives on future earnings will be critical to monitor in light of the anticipated price movements.

Evaluate Honeywell International's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honeywell International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HON

Honeywell International

Engages in the aerospace technologies, industrial automation, building automation, and energy and sustainable solutions businesses in the United States, Europe, and internationally.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives