- United States

- /

- Specialty Stores

- /

- NYSE:HD

Home Depot (NYSE:HD) Enters Bidding War With QXO For GMS Inc. Acquisition

Reviewed by Simply Wall St

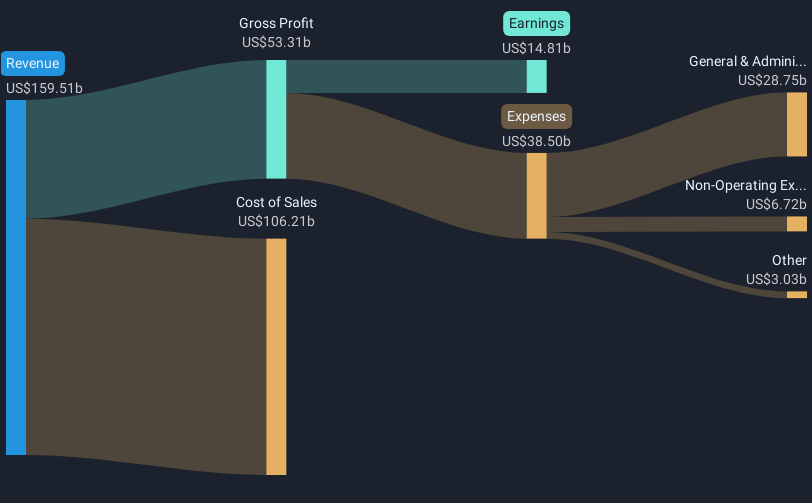

Home Depot (NYSE:HD) recently entered into discussions to acquire GMS Inc., potentially creating a bidding competition with QXO, Inc. Although this announcement lifted GMS shares significantly, Home Depot's stock experienced a 1% decline over the last quarter. This period also saw the appointment of Angie Brown as EVP and CIO, maintaining continuity in leadership, and a robust earnings report with increased sales but slightly decreased net income. Amid a generally flat market with geopolitical concerns affecting sentiment, these developments likely added weight to the overall stability in the company’s share price.

Home Depot has 2 warning signs we think you should know about.

The potential acquisition of GMS Inc. by Home Depot may impact the company's growth narrative by enhancing its Pro ecosystem and expanding its market reach. This move could strengthen Home Depot's sales integration efforts and improve revenue growth through investments in new store locations and delivery capabilities. However, the 1% decline in Home Depot's stock over the past quarter might reflect immediate market apprehensions about potential bidding competition and its implications on earnings and capital allocation.

Looking at a longer-term horizon, Home Depot's total shareholder return was 62.41% over the past five years, emphasizing consistent growth beyond short-term market fluctuations. While this performance is noteworthy, the company underperformed the US market, which returned 10.4% over the past year. Similarly, within its industry, Home Depot lagged, as the US Specialty Retail sector saw a 3.3% increase over the same period.

Anticipated changes resulting from the GMS Inc. acquisition could significantly affect Home Depot's revenue and earnings forecasts. Analysts expect revenue to grow at 3.7% annually over the next three years, although uncertainties regarding big-ticket projects due to higher interest rates may pose challenges. The recent share price movement, with Home Depot trading at US$359.38, places it below the consensus analyst price target of US$423.65, indicating a 15.2% potential upside. This suggests investor confidence in the company's long-term prospects despite short-term fluctuations.

Upon reviewing our latest valuation report, Home Depot's share price might be too optimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives