- United States

- /

- Hospitality

- /

- NYSE:HLT

Hilton Worldwide Holdings (NYSE:HLT) Removed From Four Major Russell Value Indices

Reviewed by Simply Wall St

Hilton Worldwide Holdings (NYSE:HLT) experienced a 17% share price increase over the last quarter amid significant company and market developments. The company's removal from multiple indices on June 30 represents a shift that may affect investment interest. Nevertheless, Hilton's robust first-quarter earnings performance, highlighted by increased revenue and net income, coupled with a strategic dividend and share buyback initiative, likely bolstered investor confidence. Additionally, the company's milestone hotel openings and new partnerships, including in Costa Rica and Abu Dhabi, underscore its expansion efforts. These company-specific advancements complemented broader market gains, reinforcing Hilton's positive trajectory.

Find companies with promising cash flow potential yet trading below their fair value.

The recent developments affecting Hilton Worldwide Holdings, such as its removal from multiple indices, could alter investor interest by affecting its visibility in certain funds. However, the company's expansion efforts, particularly in Europe and Asia, present growth opportunities that may offset these challenges. Over the last five years, Hilton's shares have achieved an impressive total return of 252.22%, reflecting strong long-term growth. The company's performance over the past year has outpaced both the US Hospitality industry and the broader market, where Hilton exceeded the industry return of 21.5% and the US market's 13.7% gain.

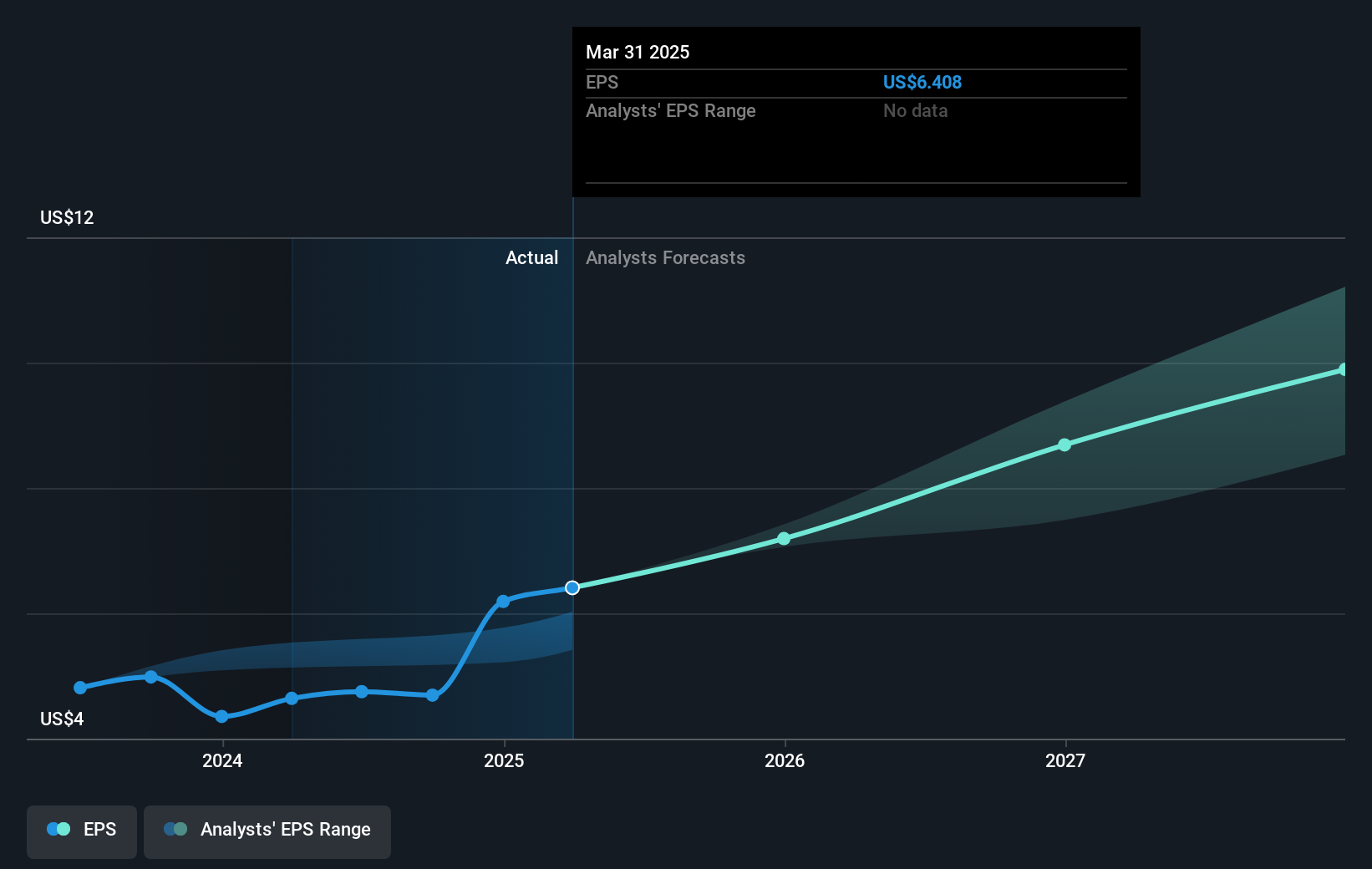

Hilton's reported growth in revenue and earnings signifies solid business fundamentals, with potential expansion in new markets potentially boosting future performance. Nonetheless, macroeconomic pressures and geopolitical tensions may pose risks to project timelines and RevPAR growth, potentially impacting Hilton's revenue and earnings forecasts. With the current share price at US$236.59, slightly below the consensus analyst price target of US$247.23, the market sentiment indicates a belief in continued positive performance, yet suggests limited short-term upside. This context highlights the importance of closely monitoring Hilton's strategic growth initiatives and broader economic conditions that could influence future shareholder returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Worldwide Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLT

Hilton Worldwide Holdings

A hospitality company, engages in managing, franchising, owning, and leasing hotels and resorts.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives