Here's Why We Think Wesfarmers (ASX:WES) Is Well Worth Watching

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Wesfarmers (ASX:WES). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Wesfarmers

How Quickly Is Wesfarmers Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud Wesfarmers's stratospheric annual EPS growth of 50%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

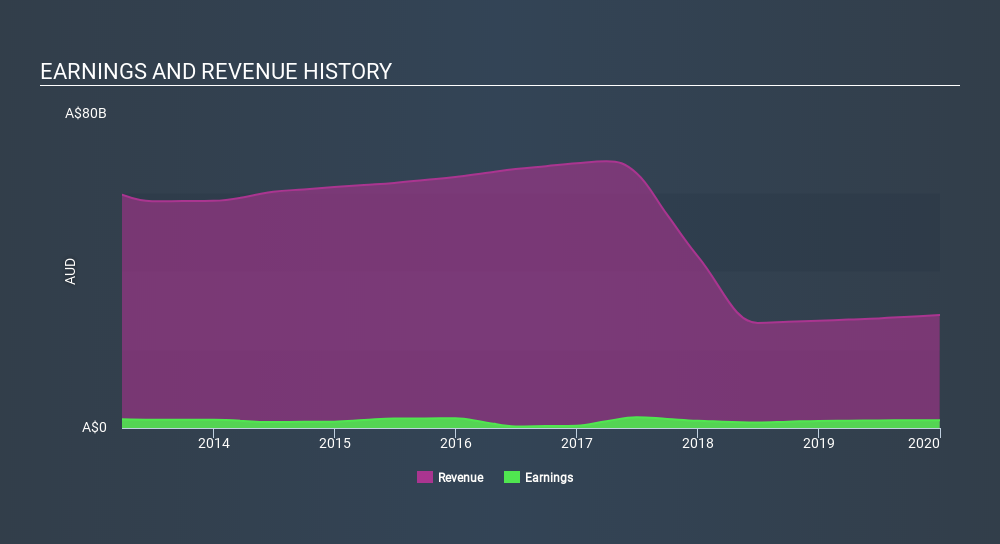

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Wesfarmers maintained stable EBIT margins over the last year, all while growing revenue 5.3% to AU$29b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Wesfarmers's future profits.

Are Wesfarmers Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for Wesfarmers shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Jennifer Westacott, the Independent Non-Executive Director of the company, paid AU$50k for shares at around AU$38.61 each.

On top of the insider buying, it's good to see that Wesfarmers insiders have a valuable investment in the business. Given insiders own a small fortune of shares, currently valued at AU$101m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

Does Wesfarmers Deserve A Spot On Your Watchlist?

Wesfarmers's earnings have taken off like any random crypto-currency did, back in 2017. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Wesfarmers belongs on the top of your watchlist. However, before you get too excited we've discovered 2 warning signs for Wesfarmers that you should be aware of.

The good news is that Wesfarmers is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:WES

Wesfarmers

Engages in the retail business in Australia, New Zealand, and internationally.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives