- Australia

- /

- Capital Markets

- /

- ASX:MQG

Here's Why We Think Macquarie Group (ASX:MQG) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Macquarie Group (ASX:MQG). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Macquarie Group

How Quickly Is Macquarie Group Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. Over the last three years, Macquarie Group has grown EPS by 15% per year. That's a pretty good rate, if the company can sustain it.

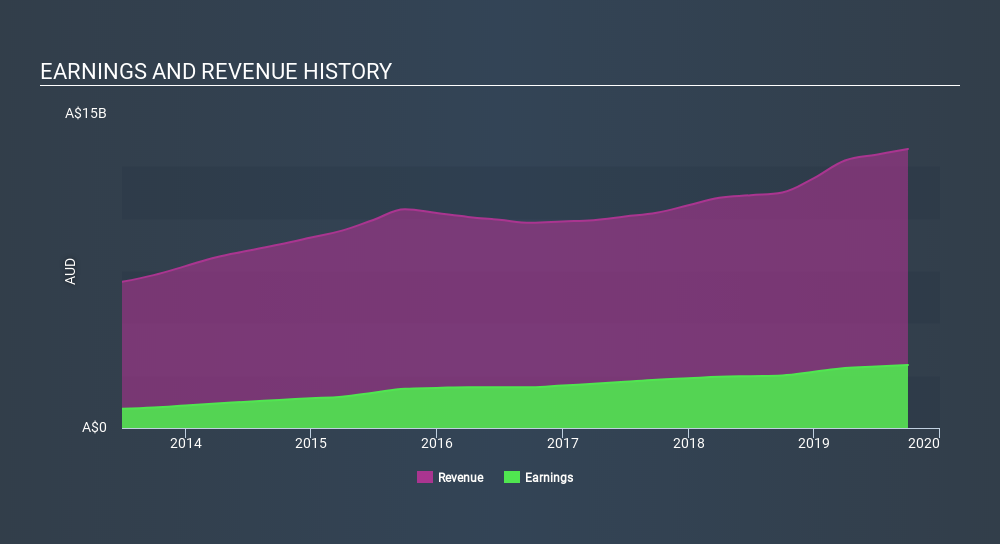

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Macquarie Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Macquarie Group's EBIT margins were flat over the last year, revenue grew by a solid 19% to AU$13b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Macquarie Group?

Are Macquarie Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news is that Macquarie Group insiders spent a whopping AU$6.1m on stock in just one year, and I didn't see any selling. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. We also note that it was the CEO, MD & Executive Voting Director, Shemara Wikramanayake, who made the biggest single acquisition, paying AU$5.6m for shares at about AU$120 each.

The good news, alongside the insider buying, for Macquarie Group bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they have a glittering mountain of wealth invested in it, currently valued at AU$378m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Does Macquarie Group Deserve A Spot On Your Watchlist?

As I already mentioned, Macquarie Group is a growing business, which is what I like to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. Still, you should learn about the 2 warning signs we've spotted with Macquarie Group .

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Macquarie Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:MQG

Macquarie Group

Provides diversified financial services in Australia, New Zealand the Americas, Europe, the Middle East, Africa, and Asia.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives