Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Temenos AG (VTX:TEMN) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Temenos

What Is Temenos's Net Debt?

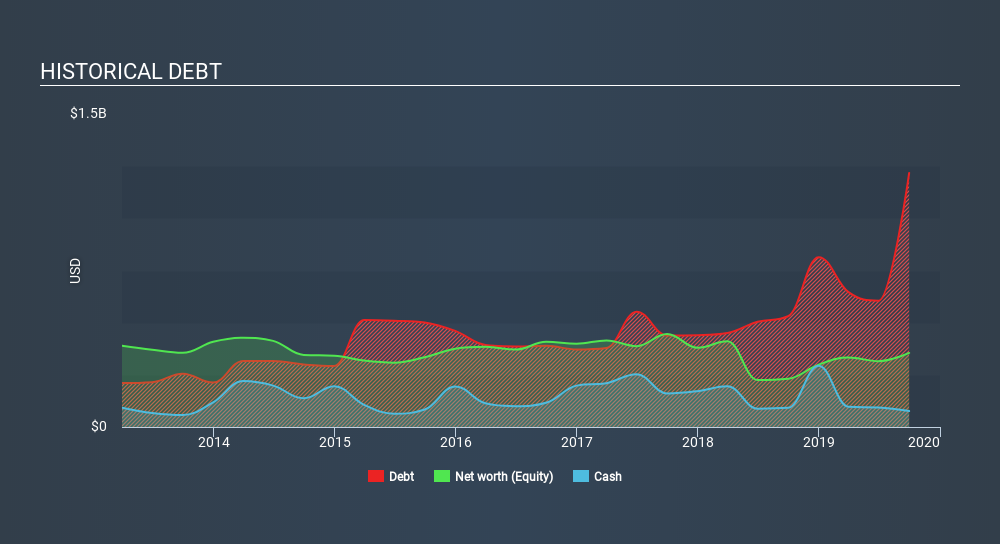

As you can see below, at the end of September 2019, Temenos had US$1.17b of debt, up from US$531 a year ago. Click the image for more detail. However, it does have US$76.7m in cash offsetting this, leading to net debt of about US$1.09b.

How Healthy Is Temenos's Balance Sheet?

According to the last reported balance sheet, Temenos had liabilities of US$508.8m due within 12 months, and liabilities of US$1.32b due beyond 12 months. Offsetting this, it had US$76.7m in cash and US$361.8m in receivables that were due within 12 months. So it has liabilities totalling US$1.40b more than its cash and near-term receivables, combined.

Given Temenos has a humongous market capitalization of US$11.6b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Temenos's net debt is 3.8 times its EBITDA, which is a significant but still reasonable amount of leverage. However, its interest coverage of 18.4 is very high, suggesting that the interest expense on the debt is currently quite low. One way Temenos could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 17%, as it did over the last year. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Temenos's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, Temenos actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

The good news is that Temenos's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But truth be told we feel its net debt to EBITDA does undermine this impression a bit. Zooming out, Temenos seems to use debt quite reasonably; and that gets the nod from us. After all, sensible leverage can boost returns on equity. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 1 warning sign for Temenos you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SWX:TEMN

Temenos

Develops, markets, and sells integrated banking software systems to banking and other financial services institutions.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives