- United States

- /

- Biotech

- /

- NasdaqGS:MYGN

Here's Why Myriad Genetics (NASDAQ:MYGN) Can Manage Its Debt Responsibly

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Myriad Genetics, Inc. (NASDAQ:MYGN) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Myriad Genetics

What Is Myriad Genetics's Net Debt?

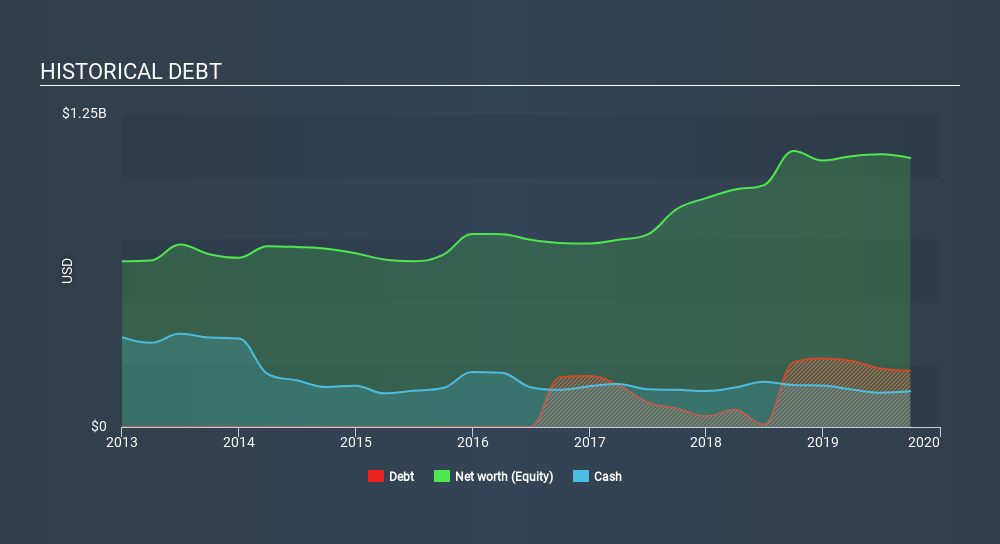

You can click the graphic below for the historical numbers, but it shows that Myriad Genetics had US$225.0m of debt in September 2019, down from US$258.0m, one year before. However, it also had US$142.6m in cash, and so its net debt is US$82.4m.

How Strong Is Myriad Genetics's Balance Sheet?

The latest balance sheet data shows that Myriad Genetics had liabilities of US$115.4m due within a year, and liabilities of US$401.3m falling due after that. Offsetting these obligations, it had cash of US$142.6m as well as receivables valued at US$121.8m due within 12 months. So it has liabilities totalling US$252.3m more than its cash and near-term receivables, combined.

Of course, Myriad Genetics has a market capitalization of US$1.94b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Given net debt is only 1.1 times EBITDA, it is initially surprising to see that Myriad Genetics's EBIT has low interest coverage of 0.097 times. So one way or the other, it's clear the debt levels are not trivial. Shareholders should be aware that Myriad Genetics's EBIT was down 98% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Myriad Genetics can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Myriad Genetics actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Myriad Genetics's EBIT growth rate was a real negative on this analysis, as was its interest cover. But its conversion of EBIT to free cash flow was significantly redeeming. When we consider all the factors mentioned above, we do feel a bit cautious about Myriad Genetics's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. We'd be motivated to research the stock further if we found out that Myriad Genetics insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:MYGN

Myriad Genetics

A molecular diagnostic testing and precision medicine company, develops and provides molecular tests in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives