- Brazil

- /

- Auto Components

- /

- BOVESPA:FRAS3

Here's What Fras-le S.A.'s (BVMF:FRAS3) Shareholder Ownership Structure Looks Like

Every investor in Fras-le S.A. (BVMF:FRAS3) should be aware of the most powerful shareholder groups. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. Companies that used to be publicly owned tend to have lower insider ownership.

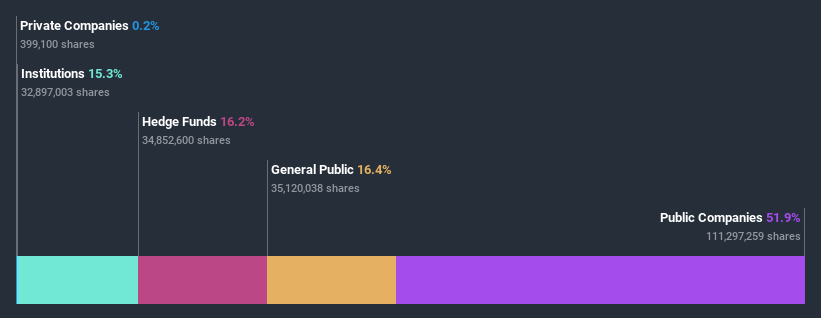

Fras-le is a smaller company with a market capitalization of R$1.2b, so it may still be flying under the radar of many institutional investors. Our analysis of the ownership of the company, below, shows that institutions are noticeable on the share registry. Let's delve deeper into each type of owner, to discover more about Fras-le.

View our latest analysis for Fras-le

What Does The Institutional Ownership Tell Us About Fras-le?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

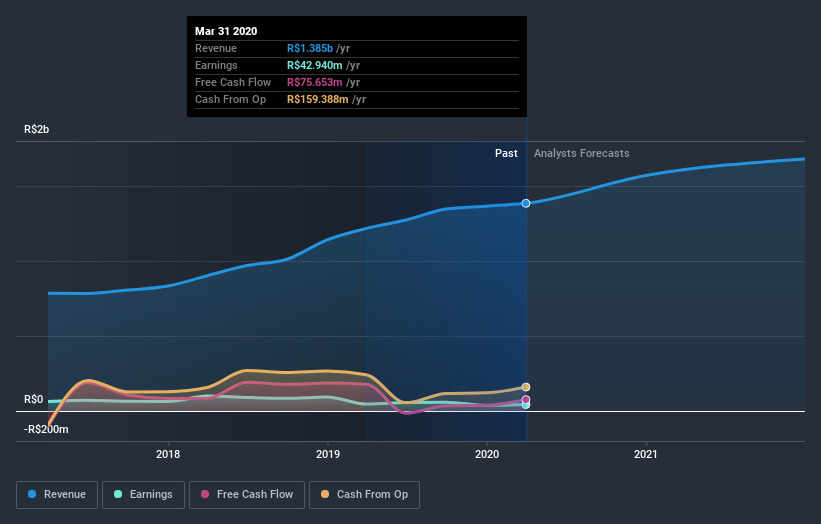

Fras-le already has institutions on the share registry. Indeed, they own a respectable stake in the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Fras-le, (below). Of course, keep in mind that there are other factors to consider, too.

Our data indicates that hedge funds own 16% of Fras-le. That worth noting, since hedge funds are often quite active investors, who may try to influence management. Many want to see value creation (and a higher share price) in the short term or medium term. Randon S.A. Implementos e Participações is currently the company's largest shareholder with 52% of shares outstanding. With such a huge stake in the ownership, we infer that they have significant control of the future of the company. Meanwhile, the second and third largest shareholders, hold 16% and 13%, of the shares outstanding, respectively.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. While there is some analyst coverage, the company is probably not widely covered. So it could gain more attention, down the track.

Insider Ownership Of Fras-le

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our data cannot confirm that board members are holding shares personally. Not all jurisdictions have the same rules around disclosing insider ownership, and it is possible we have missed something, here. So you can click here learn more about the CEO.

General Public Ownership

With a 16% ownership, the general public have some degree of sway over FRAS3. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Public Company Ownership

Public companies currently own 52% of FRAS3 stock. This may be a strategic interest and the two companies may have related business interests. It could be that they have de-merged. This holding is probably worth investigating further.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. For instance, we've identified 4 warning signs for Fras-le that you should be aware of.

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you’re looking to trade Fras-le, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BOVESPA:FRAS3

Fras-le

Provides friction materials for braking systems and other products in Brazil, England, Argentina, the United States, China, India, Uruguay, Holland, Chile, Colombia, Germany, South America, and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion