- Netherlands

- /

- Insurance

- /

- ENXTAM:ASRNL

Here's What ASR Nederland N.V.'s (AMS:ASRNL) P/E Ratio Is Telling Us

The goal of this article is to teach you how to use price to earnings ratios (P/E ratios). To keep it practical, we'll show how ASR Nederland N.V.'s (AMS:ASRNL) P/E ratio could help you assess the value on offer. ASR Nederland has a P/E ratio of 5.38, based on the last twelve months. That corresponds to an earnings yield of approximately 19%.

View our latest analysis for ASR Nederland

How Do You Calculate A P/E Ratio?

The formula for P/E is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for ASR Nederland:

P/E of 5.38 = €31.81 ÷ €5.91 (Based on the year to June 2019.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio implies that investors pay a higher price for the earning power of the business. That isn't necessarily good or bad, but a high P/E implies relatively high expectations of what a company can achieve in the future.

How Does ASR Nederland's P/E Ratio Compare To Its Peers?

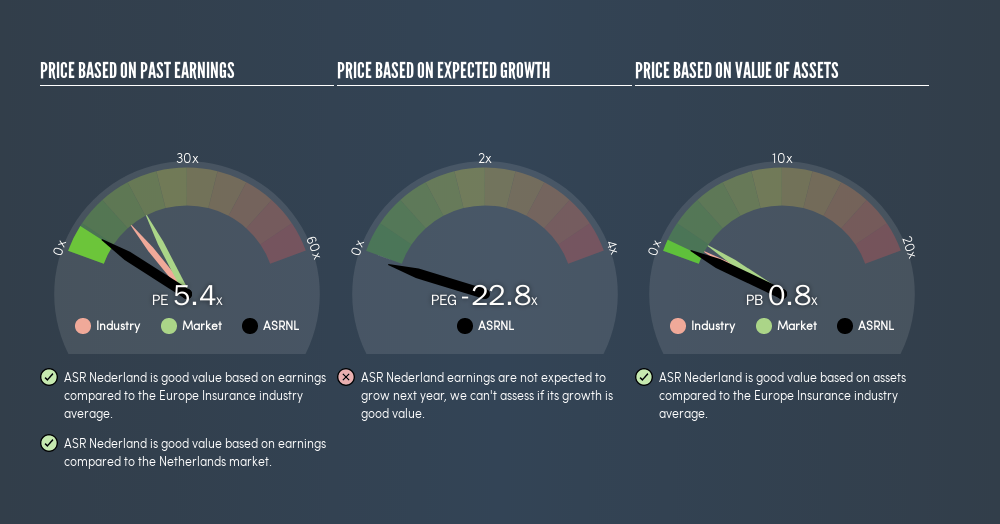

One good way to get a quick read on what market participants expect of a company is to look at its P/E ratio. We can see in the image below that the average P/E (13.2) for companies in the insurance industry is higher than ASR Nederland's P/E.

This suggests that market participants think ASR Nederland will underperform other companies in its industry.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. If earnings are growing quickly, then the 'E' in the equation will increase faster than it would otherwise. And in that case, the P/E ratio itself will drop rather quickly. So while a stock may look expensive based on past earnings, it could be cheap based on future earnings.

ASR Nederland had pretty flat EPS growth in the last year. But over the longer term (3 years), earnings per share have increased by 15%.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

Don't forget that the P/E ratio considers market capitalization. That means it doesn't take debt or cash into account. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

Is Debt Impacting ASR Nederland's P/E?

With net cash of €2.1b, ASR Nederland has a very strong balance sheet, which may be important for its business. Having said that, at 47% of its market capitalization the cash hoard would contribute towards a higher P/E ratio.

The Verdict On ASR Nederland's P/E Ratio

ASR Nederland trades on a P/E ratio of 5.4, which is below the NL market average of 18. EPS was up modestly better over the last twelve months. And the net cash position gives the company many options. So it's strange that the low P/E indicates low expectations.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine.' So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

Of course you might be able to find a better stock than ASR Nederland. So you may wish to see this free collection of other companies that have grown earnings strongly.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTAM:ASRNL

ASR Nederland

Provides insurance, pensions, and mortgages products and services for consumers, entrepreneurs, and employers in the Netherlands.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives